When most beginners think of stock trading, they imagine charts, numbers, indicators, and strategies. While technical knowledge is important, there’s another side of trading that often goes unnoticed — the mental game. At Stock Market Vidya, Nagpur, led by Mr. Prashant Sarode, we emphasize one powerful truth: Your mindset can make or break your success in the stock market.

In this in-depth blog, we’ll uncover how developing a strong trading psychology can lead to long-term success. We’ll also guide you step-by-step on how to build that mindset, how our training helps students in real-time, and why traders who master their emotions outperform others consistently.

Whether you’re a beginner or an experienced trader, this article is crafted in a conversational and easy-to-understand tone to help you truly master the psychology of trading.

What is Trading Psychology?

Trading psychology refers to the emotional and mental state that influences your trading decisions. Fear, greed, overconfidence, impatience, anxiety — these emotions can impact how you enter, manage, and exit trades.

While tools and strategies can be learned through practice, controlling your emotions takes inner work and mentorship.

At Stock Market Vidya, we don’t just teach how to trade — we train you to think like a trader. With our structured mindset-building sessions and After Course Support, we help students continuously improve their emotional control and discipline.

Why Mindset Matters More Than Strategy

Imagine two traders using the exact same strategy. One makes consistent profits, the other keeps losing. Why?

The answer lies in how they handle pressure, risk, and uncertainty.

Let’s understand it deeper:

1. Discipline Over Impulsiveness

Markets test your patience. A disciplined trader sticks to their plan even when things get tough. An impulsive trader exits early, overtrades, or jumps between strategies — all due to emotional pressure.

“Discipline is the bridge between goals and trading profits.”

We train our students at Stock Market Vidya to follow structured trading rules. No random trades. No shortcuts. Just smart, planned decisions.

2. Overcoming Fear and Greed

Fear stops you from entering good trades or holding on to winning positions. Greed makes you overtrade or stay in losing trades too long, hoping they’ll reverse.

Both emotions can cause huge losses.

At our institute in Nagpur, we focus on building emotional awareness. Our students learn how to pause, reflect, and act logically — not emotionally.

3. Consistency is King

Success in trading doesn’t come from one big trade. It comes from consistent small wins. But to be consistent, your mindset must be stable.

If you let one loss affect your next decision, you break your rhythm. We train our students to develop a trading routine that builds long-term consistency.

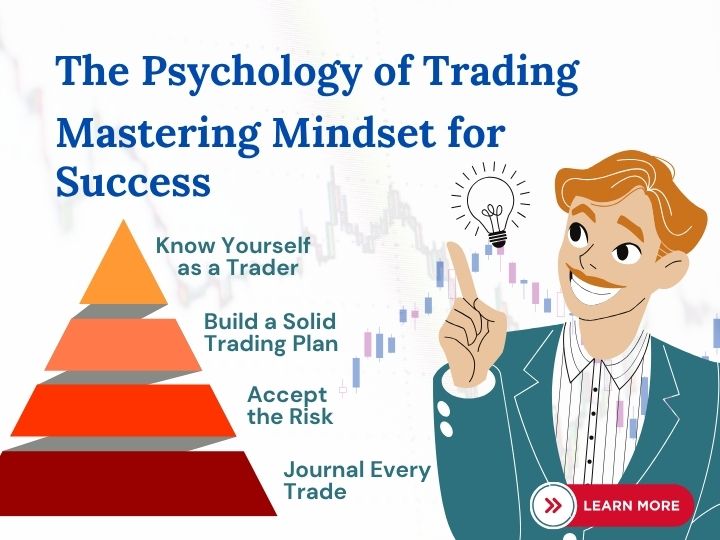

How to Master Your Trading Psychology: Step-by-Step

Let’s now walk through practical steps to build a powerful trading mindset:

Step 1: Know Yourself as a Trader

Ask yourself:

- Are you naturally patient or impulsive?

- Do you get angry or emotional when you lose?

- Do you fear missing out (FOMO)?

Self-awareness is the first step toward controlling your emotions. At Stock Market Vidya, we help students assess their trading personality with practical tests and examples.

Step 2: Build a Solid Trading Plan

A trading plan is like your GPS in the stock market. It includes your:

- Entry and exit rules

- Risk management strategy

- Position size

Having a clear plan reduces emotional decision-making. You don’t panic, because you already know what to do.

We teach our students how to write their own trading plans — and how to stick to them in real-time market situations.

Step 3: Accept the Risk

Losses are part of trading. Even the best traders lose sometimes.

But what separates a successful trader is this:

They accept the risk and don’t take losses personally.

When you understand that a loss is not a failure but just part of the process, you stop fearing it. At Stock Market Vidya, we train you to develop this emotional strength.

Step 4: Journal Every Trade

After every trade, write down:

- Why you took the trade

- How you felt before, during, and after

- What went right and what went wrong

This habit helps you track your emotional patterns. Over time, you’ll see where your mindset needs work — and how to fix it.

Step 5: Practice Mindfulness and Patience

Trading requires mental clarity. A distracted or stressed mind can’t make sharp decisions.

Practices like deep breathing, short walks, or meditation before trading can help. Many of our students have seen positive changes just by including 5 minutes of silence before the market opens.

We also teach mindset exercises in our sessions to boost clarity and focus.

Step 6: Learn from a Mentor

Trying to manage emotions on your own is hard. You need someone experienced to guide you.

That’s where Mr. Prashant Sarode’s mentorship makes the difference. At Stock Market Vidya, we offer personalized feedback, emotional guidance, and After Course Support to help you stay on track long after the course is over.

Common Psychological Traps Traders Fall Into

Let’s now look at real mental traps most traders fall into — and how to avoid them:

Trap 1: Revenge Trading

You lose money and try to make it back quickly by entering a new trade without analysis. This leads to even more losses.

Solution: Take a break. Review your mistake. Only enter again with a clear plan.

Trap 2: Overconfidence After Wins

You win a few trades and feel unbeatable. You start taking big risks. One mistake — and you lose it all.

Solution: Stay humble. Follow your risk management rules, no matter how well you’re doing.

Trap 3: Fear of Missing Out (FOMO)

You see others making money and jump into trades without analysis. You enter late — and lose.

Solution: Stick to your plan. If you miss one opportunity, don’t worry. The market gives you thousands more.

How Stock Market Vidya Builds Your Trading Psychology

At Stock Market Vidya, Nagpur, we take trading psychology seriously. It’s not just an extra topic — it’s the foundation of your success.

Here’s how we help you:

1. Mindset Training Sessions

We include dedicated sessions that focus on building patience, discipline, and emotional control.

2. Real-Time Practice

Our students trade in real-time with proper mentorship. You get feedback not just on your strategy, but on your emotional behavior.

3. After Course Support

Learning doesn’t stop when the course ends. We offer After Course Support to help you deal with emotional and trading challenges as they arise in live markets.

You’re not alone. We guide you even after the training period.

4. Mentorship from an Experienced Trainer

Mr. Prashant Sarode brings years of experience and practical knowledge. He understands how emotions affect trades — and he teaches students how to manage them with proven methods.

Frequently Asked Questions (FAQs)

1. What is the biggest mental challenge in trading?

The biggest challenge is controlling your emotions — especially fear and greed. These two feelings can destroy a good strategy if not managed properly.

2. Can anyone develop a good trading mindset?

Yes! With the right training, guidance, and consistent practice, anyone can build a strong and disciplined trading mindset.

3. How does Stock Market Vidya help with psychology?

We offer mindset sessions, live mentorship, and After Course Support to help you handle trading pressure effectively.

4. I panic during losses. What should I do?

Start journaling your trades and emotions. Work with a mentor. Take breaks when needed and follow your trading plan strictly.

5. Is trading mindset more important than technical analysis?

Both are important. But mindset is what allows you to use your strategy correctly, especially under pressure.

6. How long does it take to build a strong trading mindset?

It depends on your effort. With daily practice and proper guidance, you can see improvement in a few weeks.

7. Should I trade if I’m feeling emotional?

No. Emotional trading leads to poor decisions. Always trade with a calm and focused mind.

8. Can mindset issues cause big losses?

Absolutely. Most big losses happen not because of strategy failure, but because of emotional decisions.

9. What are some good habits for traders?

Journaling, taking breaks, meditating, reviewing your trades, and talking to a mentor are great habits.

10. How can I join Stock Market Vidya?

You can call us on 9822718163 or 8421893845. Visit our website at www.stockmarketvidya.com to get started.

Final Words: Your Mind is Your Strongest Trading Tool

Trading is not a game of luck — it’s a game of mindset. When you learn to stay calm in losses, patient in profits, and disciplined always — success follows naturally.

At Stock Market Vidya, Nagpur, we prepare you not just for the charts, but for the challenges inside your mind. With our practical training and After Course Support, you’ll not only become a better trader — you’ll become a stronger person.

Ready to master your mindset and unlock true trading success?

Call us now: 9822718163, 8421893845

Website: www.stockmarketvidya.com