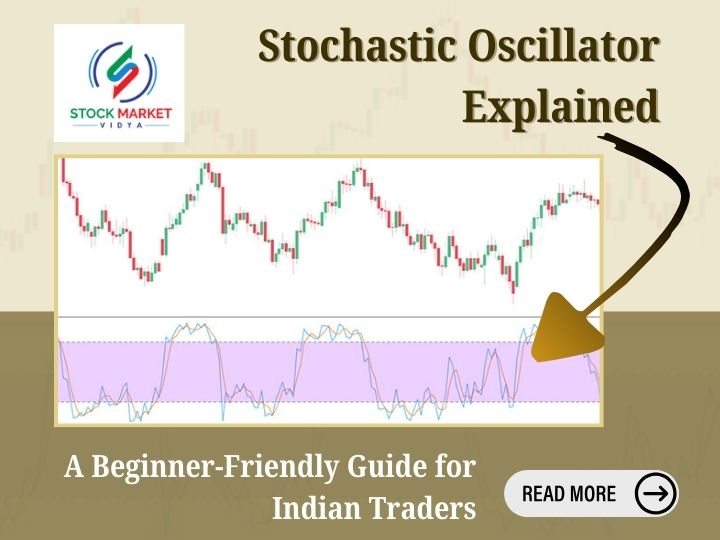

Understanding market momentum is one of the most important skills for any new trader. Whether you are a beginner learning technical analysis or someone exploring advanced indicators, the Stochastic Oscillator is a tool you will hear about again and again. It helps traders read the strength of price movements, identify turning points, catch early reversals, and build confidence in trade entries and exits.

This detailed guide is crafted especially for students and learners of Stock Market Vidya, Nagpur, a well-known share market training institute run by Mr. Prashant Sarode, an NISM Certified Trainer.

If you are searching for share trading classes in Nagpur, share market training in Nagpur, or the Best share market classes in Nagpur, understanding indicators like the Stochastic Oscillator will give you a strong foundation for real-world trading.

Let’s dive into this powerful momentum indicator step by step, using simple language and practical market examples.

Why Stochastic Oscillator Matters for Indian Traders

Indian traders deal with fast-moving markets—Nifty 50, Bank Nifty, mid-cap stocks, trending sectors, and intraday volatility. In such markets, momentum indicators are essential. The Stochastic Oscillator helps traders understand:

- When buyers are losing strength

- When sellers are getting exhausted

- When a price reversal is likely

- When a trend is slowing down

- When a stock is entering an overbought or oversold zone

Understanding these points gives you confidence when taking trades, especially when you learn through structured stock market training.

What Exactly Is the Stochastic Oscillator?

The Stochastic Oscillator is a momentum-based technical indicator that compares a stock’s current price to its price range over a specific period. In simple terms:

It tells you whether a stock is closing near its high or low of the recent price range.

This information helps traders judge market sentiment. If prices close near the high consistently, it means buyers are active. If prices close near the low repeatedly, sellers are dominating.

The Formula Made Easy

You don’t need to mug up formulas to use the Stochastic Oscillator, but basic understanding helps.

The key component is called %K, which calculates the current price position within a range:

%K ≈ Where the price is today compared to the lowest low and highest high of the last X days.

Then, there is %D, which is a 3-period moving average of %K.

For most traders, the standard setting is:

- 14 periods for calculation

- 3-period smoothing

These two lines (%K and %D) create buy and sell signals when they cross each other.

Why It’s Called “Stochastic”

The word “stochastic” simply means random or unpredictable. Yet George Lane, who introduced the indicator, famously said:

“Momentum changes direction before price.”

That is exactly why this indicator is so effective. It lets you sense a price shift before the trend actually changes on the chart.

⚡ Understanding the Key Levels: 80 and 20

Although there are no strict rules, most traders use these levels:

- Above 80 → Overbought Zone

- Below 20 → Oversold Zone

However, overbought doesn’t always mean reversal. It just indicates that price has moved too fast. Similarly, oversold means selling pressure has been high.

Indian traders often misunderstand these zones. Let’s break it:

- Overbought means price is strong, not that you should sell immediately.

- Oversold means price is weak, not that you should buy blindly.

Successful use of the Stochastic Oscillator comes from combining these zones with crossovers, trend context, and price action.

The Two Lines: %K and %D Explained Clearly

%K Line — The Fast Line

This line reacts quickly to price changes. It shows immediate momentum.

%D Line — The Signal Line

This is the smoother line and reacts slowly.

Traders look for crossovers between %K and %D for entry and exit points.

When %K crosses above %D → potential buy.

When %K crosses below %D → potential sell.

This basic movement is used in almost every Stochastic trading strategy.

Fast Stochastic vs Slow Stochastic

To make things easier, charting platforms provide two versions:

Fast Stochastic

- More reactive

- More signals

- Best for intraday traders

Slow Stochastic

- Smoother

- More reliable

- Best for positional & swing traders

Indian traders using share trading classes in Nagpur often learn both, but practice helps you choose the right version based on your trading style.

How Indian Traders Use Stochastic in Real Charts

Let’s take typical market examples:

- Nifty is rallying:

Stochastic stays above 80 for long durations—indicating strong buying momentum.

- A stock is falling sharply:

Stochastic slips quickly below 20 and stays there—showing strong selling.

- During sideways markets:

Stochastic swings between 20 and 80—ideal for range trading.

This is why many students taking share market training in Nagpur learn Stochastic as one of the primary indicators.

The Most Popular Signals Using Stochastic

Let’s break down actual signals traders use:

1. Overbought & Oversold Signals

- When Stochastic goes above 80, be cautious about longs.

- When it goes below 20, be cautious about shorts.

But do not enter trades only based on these levels.

2. %K and %D Crossovers

These crossovers create precise entry and exit points.

- Bullish crossover → Buy signal

- Bearish crossover → Sell signal

Crossovers work best when combined with price action.

3. Divergence Signals

A divergence forms when:

- Price makes a new high but Stochastic doesn’t

- Price makes a new low but Stochastic doesn’t

It often hints at trend reversal.

4. Overbought but Trending Market

Many beginners misunderstand this.

A stock can remain overbought for days or weeks during a strong uptrend.

This is why you must always check the trend using:

- Moving Average

- Trendline

- Price structure

before deciding your trade.

Stochastic Trading Strategies You Can Start Using Today

Now, let’s explore strategies that are beginner-friendly and commonly taught in Best share market classes in Nagpur like Stock Market Vidya.

1. Basic Reversal Strategy

- Identify overbought/oversold level

- Wait for %K–%D crossover

- Confirm with price structure

- Enter trade with tight risk management

This works best in range-bound markets.

2. Trend Continuation Strategy

This is more advanced but powerful.

Steps:

- Identify a clear uptrend or downtrend

- Look for pullback

- Stochastic should fall to 20–40 zone in an uptrend

- Buy when %K crosses above %D

This strategy helps catch strong trending moves.

3. Stochastic With Support & Resistance

The most reliable way to use the indicator:

- Wait for Stochastic to reach oversold at support

- Wait for Stochastic to reach overbought at resistance

This combination filters out false signals.

4. Stochastic With Moving Averages

Many Indian traders use:

Steps:

- Identify direction using EMA

- Use Stochastic for timing entries

- Trade in the direction of trend only

This method reduces losses due to wrong trend interpretation.

Common Mistakes Beginners Make With Stochastic

Avoid these simple mistakes:

❌ Entering trades just because Stochastic is high or low

Overbought doesn’t mean sell. Oversold doesn’t mean buy.

❌ Using Stochastic in strong trending markets

It gives too many signals and confuses traders.

❌ Taking every crossover

Crossovers need trend context and confirmation.

❌ Using only one timeframe

Always match your trading timeframe with a higher timeframe.

❌ Using Stochastic without proper stock market training

Indicators give clarity only when paired with knowledge + discipline.

Importance of Learning Indicators in a Structured Training Environment

Indicators like Stochastic become meaningful when they are learned under proper guidance.

This is why many students prefer:

- share trading classes in Nagpur

- share market training in Nagpur

- and the Best share market classes in Nagpur

offered by Stock Market Vidya. With real chart examples, market psychology training, and practical demonstrations, you gain confidence to use tools like Stochastic effectively.

How Stochastic Helps You Grow as a Trader

By learning and mastering the Stochastic Oscillator, you can:

- Read market momentum

- Identify early trend shifts

- Find low-risk entries

- Avoid impulsive trades

- Build disciplined strategies

- Improve your accuracy

This indicator becomes a stepping stone to advance into other tools such as RSI, MACD, and Bollinger Bands.

Final Thoughts: Stochastic Oscillator Is Simple Yet Powerful

The Indian stock market is dynamic, and traders need tools that help them take timely and accurate decisions. The Stochastic Oscillator is one such tool—simple, effective, and beginner-friendly.

If you are serious about learning trading the right way, indicators like Stochastic will deepen your understanding of technical analysis. And learning under professional guidance makes the process smoother and more practical.

For structured learning, mentorship, and real-chart trading knowledge, explore the Best share market classes in Nagpur at Stock Market Vidya.

Contact Stock Market Vidya, Nagpur

For admissions, batch details, demo classes, and course information:

Mobile: 9822718163, 8421893845

Website: www.stockmarketvidya.com

[{"id":708,"link":"https:\/\/stockmarketvidya.com\/blogs\/iron-condor-strategy-explained-learn-smart-options-trading-the-right-way\/","name":"iron-condor-strategy-explained-learn-smart-options-trading-the-right-way","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/02\/Iron-Condor-Strategy-Explained-\u2013-1.jpg","alt":"Iron Condor Strategy Explained"},"title":"Iron Condor Strategy Explained \u2013 Learn Smart Options Trading the Right Way","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Feb 5, 2026","dateGMT":"2026-02-05 01:17:00","modifiedDate":"2026-02-04 15:19:56","modifiedDateGMT":"2026-02-04 15:19:56","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/advanced-options-trading\/' rel='post_tag'>Advanced Options Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bank-nifty-iron-condor\/' rel='post_tag'>BANK NIFTY Iron Condor<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/iron-condor-options-trading\/' rel='post_tag'>Iron Condor Options Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/iron-condor-strategy\/' rel='post_tag'>iron condor strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nifty-iron-condor\/' rel='post_tag'>NIFTY Iron Condor<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nism-certified-trainer\/' rel='post_tag'>NISM Certified Trainer<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/non-directional-options-strategy\/' rel='post_tag'>Non Directional Options Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/option-selling-strategies\/' rel='post_tag'>Option Selling Strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-selling-strategy\/' rel='post_tag'>Options selling strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-course\/' rel='post_tag'>options trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/professional-options-trading\/' rel='post_tag'>professional options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/risk-managed-trading\/' rel='post_tag'>Risk Managed Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes-in-nagpur\/' rel='post_tag'>Share Market Classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training-nagpur\/' rel='post_tag'>stock market training Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/theta-decay-strategy\/' rel='post_tag'>Theta Decay Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/volatility-trading\/' rel='post_tag'>Volatility Trading<\/a>"},"readTime":{"min":5,"sec":57},"status":"publish","excerpt":""},{"id":704,"link":"https:\/\/stockmarketvidya.com\/blogs\/iron-collar-strategy-explained-smart-risk-control-options-strategy-for-indian-traders\/","name":"iron-collar-strategy-explained-smart-risk-control-options-strategy-for-indian-traders","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/02\/Iron-Collar-Strategy-Explained.jpg","alt":"Iron Collar Strategy Explained: Smart Risk Control Options Strategy for Indian Traders"},"title":"Iron Collar Strategy Explained: Smart Risk Control Options Strategy for Indian Traders","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Feb 3, 2026","dateGMT":"2026-02-03 10:48:33","modifiedDate":"2026-02-03 10:48:34","modifiedDateGMT":"2026-02-03 10:48:34","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/advanced-options-strategies\/' rel='post_tag'>Advanced Options Strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/capital-protection-strategy\/' rel='post_tag'>capital protection strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/defined-risk-trading\/' rel='post_tag'>defined risk trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/hedged-options-trading\/' rel='post_tag'>hedged options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/indian-stock-market-options\/' rel='post_tag'>Indian stock market options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/iron-collar-options-strategy\/' rel='post_tag'>iron collar options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/iron-collar-strategy\/' rel='post_tag'>iron collar strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/limited-risk-options-strategy\/' rel='post_tag'>limited risk options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/option-selling-strategy\/' rel='post_tag'>option selling strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-hedging-strategy\/' rel='post_tag'>options hedging strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-course-nagpur\/' rel='post_tag'>options trading course Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-in-india\/' rel='post_tag'>Options Trading in India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/prashant-sarode-nism-certified\/' rel='post_tag'>Prashant Sarode NISM certified<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/professional-options-trading\/' rel='post_tag'>professional options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/risk-control-in-options-trading\/' rel='post_tag'>risk control in options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/rule-based-trading\/' rel='post_tag'>rule based trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/sideways-market-options-strategy\/' rel='post_tag'>sideways market options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/smart-options-trading\/' rel='post_tag'>smart options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course-in-nagpur\/' rel='post_tag'>stock market course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya-nagpur\/' rel='post_tag'>Stock Market Vidya Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-options-trading\/' rel='post_tag'>stock options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/trading-psychology\/' rel='post_tag'>Trading Psychology<\/a>"},"readTime":{"min":5,"sec":58},"status":"publish","excerpt":""},{"id":696,"link":"https:\/\/stockmarketvidya.com\/blogs\/bear-put-spread-strategy-explained-a-smart-options-trading-method-for-falling-markets\/","name":"bear-put-spread-strategy-explained-a-smart-options-trading-method-for-falling-markets","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/Bear-Put-Spread-Strategy-Explained.jpg","alt":"Bear Put Spread Strategy - Stock Marketing Training Nagpur"},"title":"Bear Put Spread Strategy Explained: A Smart Options Trading Method for Falling Markets","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 31, 2026","dateGMT":"2026-01-31 01:00:00","modifiedDate":"2026-01-30 14:47:36","modifiedDateGMT":"2026-01-30 14:47:36","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bank-nifty-options\/' rel='post_tag'>Bank Nifty options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bear-put-spread\/' rel='post_tag'>Bear Put Spread<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bear-put-spread-strategy\/' rel='post_tag'>Bear Put Spread Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bearish-options-strategy\/' rel='post_tag'>Bearish Options Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nifty-options-strategy\/' rel='post_tag'>Nifty Options Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-basics\/' rel='post_tag'>Options trading basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/professional-trading-strategies\/' rel='post_tag'>Professional Trading Strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya\/' rel='post_tag'>Stock Market Vidya<\/a>"},"readTime":{"min":9,"sec":19},"status":"publish","excerpt":""},{"id":689,"link":"https:\/\/stockmarketvidya.com\/blogs\/covered-call-strategy-explained-how-indian-traders-earn-regular-income-from-the-stock-market\/","name":"covered-call-strategy-explained-how-indian-traders-earn-regular-income-from-the-stock-market","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/The-investment-guide-Learn-about-how-to-deal-with-the-crisis-Learn-about-how-to-analyze-opportunities.jpg","alt":"Covered Call Strategy Explained"},"title":"Covered Call Strategy Explained: How Indian Traders Earn Regular Income from the Stock Market","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 29, 2026","dateGMT":"2026-01-29 05:20:19","modifiedDate":"2026-01-29 05:23:02","modifiedDateGMT":"2026-01-29 05:23:02","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/covered-call-options\/' rel='post_tag'>Covered Call Options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/covered-call-strategy\/' rel='post_tag'>Covered Call Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/income-strategy-in-stock-market\/' rel='post_tag'>Income Strategy in Stock Market<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nism-certified-trainer\/' rel='post_tag'>NISM Certified Trainer<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-india\/' rel='post_tag'>Options trading India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/prashant-sarode\/' rel='post_tag'>Prashant Sarode<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya-nagpur\/' rel='post_tag'>Stock Market Vidya Nagpur<\/a>"},"readTime":{"min":9,"sec":36},"status":"publish","excerpt":""},{"id":677,"link":"https:\/\/stockmarketvidya.com\/blogs\/bear-call-spread-strategy-explained-a-smart-options-trading-method-for-sideways-to-falling-markets\/","name":"bear-call-spread-strategy-explained-a-smart-options-trading-method-for-sideways-to-falling-markets","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/Bear-Call-Spread-Strategy11.jpg","alt":"Bear-Call-Spread-Strategy"},"title":"Bear Call Spread Strategy Explained: A Smart Options Trading Method for Sideways to Falling Markets","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 24, 2026","dateGMT":"2026-01-24 12:21:15","modifiedDate":"2026-01-27 10:12:22","modifiedDateGMT":"2026-01-27 10:12:22","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/advanced-options-strategies\/' rel='post_tag'>Advanced Options Strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bear-call-spread\/' rel='post_tag'>Bear Call Spread<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bear-call-spread-strategy\/' rel='post_tag'>Bear Call Spread Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bearish-market-strategy\/' rel='post_tag'>Bearish Market Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bearish-options-strategy\/' rel='post_tag'>Bearish Options Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/call-option-selling\/' rel='post_tag'>Call Option Selling<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/credit-spread-strategy\/' rel='post_tag'>Credit spread strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/derivatives-trading\/' rel='post_tag'>Derivatives Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nism-options-trading\/' rel='post_tag'>NISM Options Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/option-spread-strategy\/' rel='post_tag'>Option Spread Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-course\/' rel='post_tag'>options trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-in-india\/' rel='post_tag'>Options Trading in India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/risk-limited-strategy\/' rel='post_tag'>Risk Limited Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes-in-nagpur\/' rel='post_tag'>Share Market Classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-options\/' rel='post_tag'>Stock Market Options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya\/' rel='post_tag'>Stock Market Vidya<\/a>"},"readTime":{"min":6,"sec":22},"status":"publish","excerpt":""},{"id":672,"link":"https:\/\/stockmarketvidya.com\/blogs\/what-is-a-bull-put-spread-simple-explanation-with-real-market-logic\/","name":"what-is-a-bull-put-spread-simple-explanation-with-real-market-logic","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/What-Is-a-Bull-Put-Spread.jpg","alt":"What Is a Bull Put Spread? share trading classes in Nagpur"},"title":"What Is a Bull Put Spread? Simple Explanation with Real-Market Logic","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 22, 2026","dateGMT":"2026-01-22 13:01:24","modifiedDate":"2026-01-22 13:08:10","modifiedDateGMT":"2026-01-22 13:08:10","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bank-nifty-options\/' rel='post_tag'>Bank Nifty options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-put-spread\/' rel='post_tag'>Bull Put Spread<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-put-spread-explained\/' rel='post_tag'>Bull Put Spread explained<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-put-spread-strategy\/' rel='post_tag'>Bull Put Spread strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/credit-spread-strategy\/' rel='post_tag'>Credit spread strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/index-options-trading\/' rel='post_tag'>Index options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/indian-stock-market-training\/' rel='post_tag'>Indian stock market training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/learn-options-trading\/' rel='post_tag'>Learn options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/low-risk-options-strategy\/' rel='post_tag'>low risk options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nifty-options-trading\/' rel='post_tag'>Nifty options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-selling-strategy\/' rel='post_tag'>Options selling strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-basics\/' rel='post_tag'>Options trading basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-classes-in-nagpur\/' rel='post_tag'>options trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-india\/' rel='post_tag'>Options trading India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/put-option-strategy\/' rel='post_tag'>Put option strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-near-me\/' rel='post_tag'>share market course near me<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-education-india\/' rel='post_tag'>stock market education India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/what-is-bull-put-spread\/' rel='post_tag'>What is Bull Put Spread<\/a>"},"readTime":{"min":6,"sec":20},"status":"publish","excerpt":""},{"id":663,"link":"https:\/\/stockmarketvidya.com\/blogs\/top-10-popular-world-indices-every-trader-and-investor-must-know\/","name":"top-10-popular-world-indices-every-trader-and-investor-must-know","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/Top-10-Popular-World-Indices-Every-Trader-and-Investor-Must-Know.jpg","alt":"Top 10 Popular World Indices Every Trader and Investor Must Know Nagpur"},"title":"Top 10 Popular World Indices Every Trader and Investor Must Know","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 18, 2026","dateGMT":"2026-01-18 11:19:58","modifiedDate":"2026-01-18 11:44:32","modifiedDateGMT":"2026-01-18 11:44:32","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/dax-index\/' rel='post_tag'>DAX index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/dow-jones-index\/' rel='post_tag'>Dow Jones index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/ftse-100-index\/' rel='post_tag'>FTSE 100 index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/global-indices-impact-on-indian-market\/' rel='post_tag'>global indices impact on Indian market<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/global-market-indices\/' rel='post_tag'>global market indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/global-stock-indices\/' rel='post_tag'>global stock indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/global-stock-market-for-beginners\/' rel='post_tag'>global stock market for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/hang-seng-index\/' rel='post_tag'>Hang Seng index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/international-stock-indices\/' rel='post_tag'>international stock indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/major-world-indices\/' rel='post_tag'>major world indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/msci-world-index\/' rel='post_tag'>MSCI World Index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nasdaq-index\/' rel='post_tag'>Nasdaq index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nifty-vs-global-indices\/' rel='post_tag'>Nifty vs global indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nikkei-225-index\/' rel='post_tag'>Nikkei 225 index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/popular-world-indices\/' rel='post_tag'>popular world indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/prashant-sarode\/' rel='post_tag'>Prashant Sarode<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/sp-500-index\/' rel='post_tag'>S&P 500 index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/sensex-global-comparison\/' rel='post_tag'>Sensex global comparison<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-learning\/' rel='post_tag'>share market learning<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-basics\/' rel='post_tag'>stock market basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-education\/' rel='post_tag'>Stock market education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training-institute\/' rel='post_tag'>stock market training institute<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya-nagpur\/' rel='post_tag'>Stock Market Vidya Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/top-global-indices\/' rel='post_tag'>top global indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/world-indices-explained\/' rel='post_tag'>world indices explained<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/world-indices-for-indian-traders\/' rel='post_tag'>world indices for Indian traders<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/world-stock-market-indices\/' rel='post_tag'>world stock market indices<\/a>"},"readTime":{"min":6,"sec":2},"status":"publish","excerpt":""},{"id":659,"link":"https:\/\/stockmarketvidya.com\/blogs\/is-bull-call-spread-profitable-risk-controlled-options-strategy-explained\/","name":"is-bull-call-spread-profitable-risk-controlled-options-strategy-explained","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/Is-Bull-Call-Spread-Profitable.jpg","alt":"Is Bull Call Spread Profitable"},"title":"Is Bull Call Spread Profitable? Risk-Controlled Options Strategy Explained","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 15, 2026","dateGMT":"2026-01-15 16:44:15","modifiedDate":"2026-01-15 16:53:24","modifiedDateGMT":"2026-01-15 16:53:24","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/beginner-options-trading-strategy\/' rel='post_tag'>beginner options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-calculation\/' rel='post_tag'>Bull Call Spread calculation<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-example\/' rel='post_tag'>Bull Call Spread example<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-explained\/' rel='post_tag'>Bull Call Spread explained<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-for-beginners\/' rel='post_tag'>Bull Call Spread for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-in-options-trading\/' rel='post_tag'>Bull Call Spread in options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-option-chain-example\/' rel='post_tag'>Bull Call Spread option chain example<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-options-strategy\/' rel='post_tag'>Bull Call Spread options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-payoff-explanation\/' rel='post_tag'>Bull Call Spread payoff explanation<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-profit-and-loss\/' rel='post_tag'>Bull Call Spread profit and loss<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-strategy\/' rel='post_tag'>Bull Call Spread strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-strategy-for-bank-nifty\/' rel='post_tag'>Bull Call Spread strategy for Bank Nifty<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-strategy-for-nifty\/' rel='post_tag'>Bull Call Spread strategy for Nifty<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-strategy-in-india\/' rel='post_tag'>Bull Call Spread strategy in India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-vs-long-call\/' rel='post_tag'>Bull Call Spread vs Long Call<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bullish-options-strategy\/' rel='post_tag'>bullish options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/call-option-strategies\/' rel='post_tag'>call option strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/how-bull-call-spread-works\/' rel='post_tag'>How Bull Call Spread works<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/is-bull-call-spread-profitable\/' rel='post_tag'>Is Bull Call Spread profitable<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/low-risk-options-strategy\/' rel='post_tag'>low risk options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nism-certified-stock-market-trainer\/' rel='post_tag'>NISM certified stock market trainer<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/option-spread-strategies\/' rel='post_tag'>option spread strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-classes-in-nagpur\/' rel='post_tag'>options trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-course\/' rel='post_tag'>options trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/risk-defined-options-strategy\/' rel='post_tag'>risk defined options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-near-me\/' rel='post_tag'>share market course near me<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/what-is-bull-call-spread\/' rel='post_tag'>What is Bull Call Spread<\/a>"},"readTime":{"min":6,"sec":18},"status":"publish","excerpt":""},{"id":646,"link":"https:\/\/stockmarketvidya.com\/blogs\/how-to-start-commodity-trading-in-india-with-small-capital-a-practical-learning-guide-for-smart-beginners\/","name":"how-to-start-commodity-trading-in-india-with-small-capital-a-practical-learning-guide-for-smart-beginners","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/How-to-Start-Commodity-Trading-in-India-with-Small-Capital.jpg","alt":"How to Start Commodity Trading in India with Small Capital: A Practical Learning Guide for Smart Beginners in Nagpur"},"title":"How to Start Commodity Trading in India with Small Capital: A Practical Learning Guide for Smart Beginners","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 10, 2026","dateGMT":"2026-01-10 14:54:33","modifiedDate":"2026-01-10 15:02:49","modifiedDateGMT":"2026-01-10 15:02:49","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-futures-trading\/' rel='post_tag'>commodity futures trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-market-india\/' rel='post_tag'>commodity market India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-options-trading\/' rel='post_tag'>commodity options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading\/' rel='post_tag'>commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-basics\/' rel='post_tag'>commodity trading basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-classes\/' rel='post_tag'>commodity trading classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-course\/' rel='post_tag'>commodity trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-education\/' rel='post_tag'>commodity trading education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-for-beginners\/' rel='post_tag'>commodity trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-in-india\/' rel='post_tag'>commodity trading in India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-strategies\/' rel='post_tag'>commodity trading strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-with-small-capital\/' rel='post_tag'>commodity trading with small capital<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/derivative-trading-india\/' rel='post_tag'>derivative trading India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/how-to-start-commodity-trading\/' rel='post_tag'>how to start commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/mcx-commodity-trading\/' rel='post_tag'>MCX commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/ncdex-commodity-trading\/' rel='post_tag'>NCDEX commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/online-commodity-trading\/' rel='post_tag'>online commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-near-me\/' rel='post_tag'>share market course near me<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/trading-education-india\/' rel='post_tag'>trading education india<\/a>"},"readTime":{"min":5,"sec":48},"status":"publish","excerpt":""},{"id":638,"link":"https:\/\/stockmarketvidya.com\/blogs\/what-does-gift-nifty-indicate-before-market-opens-in-india-a-traders-pre-market-compass\/","name":"what-does-gift-nifty-indicate-before-market-opens-in-india-a-traders-pre-market-compass","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/What-Does-Gift-Nifty-Indicate-Before-Market-Opens-in-India.jpg","alt":"What Does Gift Nifty Indicate Before Market Opens in India? A Trader\u2019s Pre-Market Compass"},"title":"What Does Gift Nifty Indicate Before Market Opens in India? A Trader\u2019s Pre-Market Compass","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 8, 2026","dateGMT":"2026-01-08 11:48:11","modifiedDate":"2026-01-08 11:50:08","modifiedDateGMT":"2026-01-08 11:50:08","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":6,"sec":29},"status":"publish","excerpt":""},{"id":632,"link":"https:\/\/stockmarketvidya.com\/blogs\/what-is-currency-trading-a-simple-guide-for-indian-beginners\/","name":"what-is-currency-trading-a-simple-guide-for-indian-beginners","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/What-Is-Currency-Trading.jpg","alt":"What Is Currency Trading? Currency Trading Course in Nagpur"},"title":"What Is Currency Trading? A Simple Guide for Indian Beginners","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 6, 2026","dateGMT":"2026-01-06 16:15:28","modifiedDate":"2026-01-06 16:16:56","modifiedDateGMT":"2026-01-06 16:16:56","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/currency-trading\/\" rel=\"category tag\">Currency Trading<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/currency-trading\/\" rel=\"category tag\">Currency Trading<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":6,"sec":30},"status":"publish","excerpt":""},{"id":621,"link":"https:\/\/stockmarketvidya.com\/blogs\/how-crypto-trading-works-understanding-bitcoin-altcoins-and-market-trends\/","name":"how-crypto-trading-works-understanding-bitcoin-altcoins-and-market-trends","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/How-Crypto-Trading-Works.jpg","alt":"How Crypto Trading Works: Crypto Trading Course in Nagpur"},"title":"How Crypto Trading Works: Understanding Bitcoin, Altcoins, and Market Trends","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 3, 2026","dateGMT":"2026-01-03 08:09:45","modifiedDate":"2026-01-03 08:30:32","modifiedDateGMT":"2026-01-03 08:30:32","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/crypto-trading\/\" rel=\"category tag\">Crypto Trading<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/crypto-trading\/\" rel=\"category tag\">Crypto Trading<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/altcoin-trading\/' rel='post_tag'>altcoin trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bitcoin-and-altcoins\/' rel='post_tag'>bitcoin and altcoins<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bitcoin-trading\/' rel='post_tag'>bitcoin trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-market-trends\/' rel='post_tag'>crypto market trends<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-risk-management\/' rel='post_tag'>crypto risk management<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-technical-analysis\/' rel='post_tag'>crypto technical analysis<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading\/' rel='post_tag'>crypto trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-basics\/' rel='post_tag'>crypto trading basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-classes\/' rel='post_tag'>crypto trading classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-course\/' rel='post_tag'>crypto trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-education\/' rel='post_tag'>crypto trading education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-for-beginners\/' rel='post_tag'>crypto trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-psychology\/' rel='post_tag'>crypto trading psychology<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-training\/' rel='post_tag'>crypto trading training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/cryptocurrency-trading\/' rel='post_tag'>cryptocurrency trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/financial-market-training\/' rel='post_tag'>financial market training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/how-crypto-trading-works\/' rel='post_tag'>how crypto trading works<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/learn-crypto-trading\/' rel='post_tag'>learn crypto trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-education\/' rel='post_tag'>Stock market education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/trading-education-in-india\/' rel='post_tag'>trading education in India<\/a>"},"readTime":{"min":6,"sec":31},"status":"publish","excerpt":""}]