When traders think about options trading, most beginners focus only on buying Call or Put options and hoping the market moves strongly in one direction. But experienced traders know one important truth — markets spend most of their time moving sideways .

This is exactly where the Iron Condor Strategy becomes powerful.

The Iron Condor is one of the most popular non-directional options trading strategies

At Stock Market Vidya, Nagpur Mr. Prashant Sarode (NISM Certified Trainer) , traders are trained to understand not just strategies, but market behavior, risk management, and execution discipline — which are critical for options trading success.

What Is the Iron Condor Strategy? (Simple Explanation) The Iron Condor Strategy is an options selling strategy that profits when the price of an index or stock stays within a defined range till expiry.

Instead of predicting whether the market will go up or down, this strategy works on a simple idea:

“The market will not move too much.”

In Iron Condor, a trader:

Sells an out-of-the-money Call option

Sells an out-of-the-money Put option

Buys a higher Call option for protection

Buys a lower Put option for protection

This creates a limited-risk, limited-reward strategy

Why Iron Condor Is a Favorite Among Professional Traders Most retail traders lose money because they chase big moves. Iron Condor traders think differently.

Here’s why this strategy is loved by professionals:

It benefits from time decay (Theta)

It works best in low volatility markets

Risk and reward are pre-defined

No need to predict market direction

High probability strategy when executed correctly

This is why advanced share market training in Nagpur option selling strategies like Iron Condor.

Market Conditions Best Suited for Iron Condor

Iron Condor does NOT work in all market conditions. Understanding when not to trade is as important as knowing how to trade.

This strategy works best when:

The market is moving sideways

Volatility is moderate to low

No major events like RBI policy, Budget, or results

Index options like NIFTY or BANK NIFTY are stable

It performs poorly when:

Market breaks into a strong trend

Sudden volatility spikes occur

Big global or domestic news is expected

At Best share market classes in Nagpur market context reading before applying any strategy.

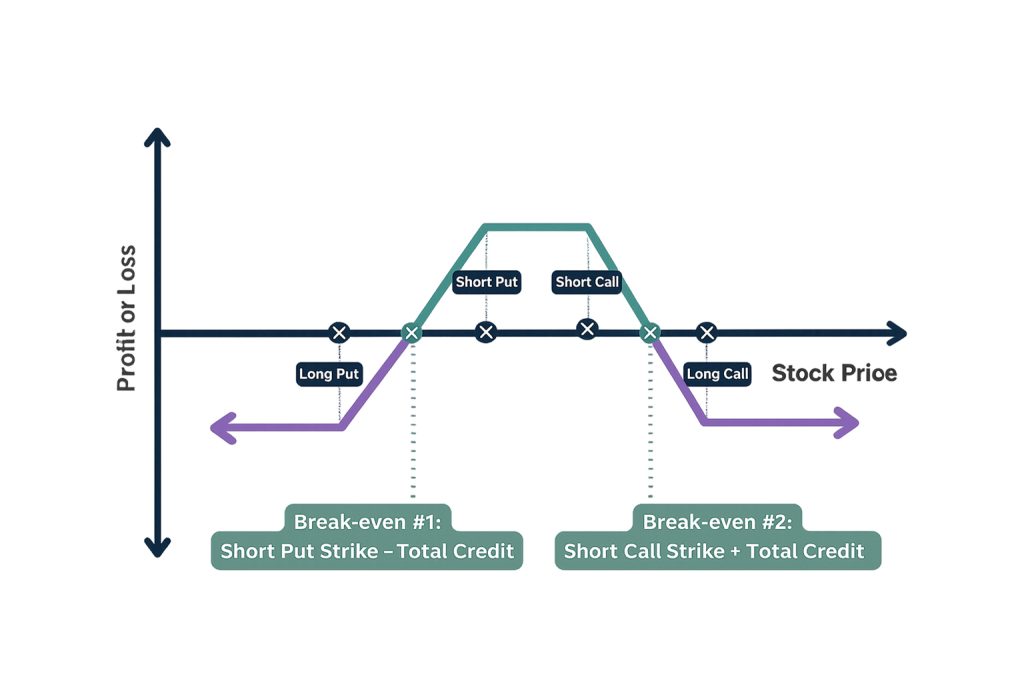

Structure of the Iron Condor Strategy (Conceptual Understanding) Let’s understand the structure without numbers or tables.

An Iron Condor consists of two spreads :

1) Call Side (Upper Range)

Sell a Call option above the current price

Buy a higher Call option to limit risk

2)Put Side (Lower Range)

Sell a Put option below the current price

Buy a lower Put option to limit risk

Together, this creates a price range within which the market should remain till expiry for maximum profit.

How Does the Iron Condor Make Money? The profit comes mainly from:

Option premium decay Reduction in volatility

Time passing without major price movement

As expiry approaches:

Sold options lose value faster

Bought options act as protection

Net premium collected becomes profit

This concept of time decay is a core pillar taught in every professional stock market course focused on options trading.

Risk and Reward Nature of Iron Condor One of the biggest advantages of Iron Condor is clarity .

Before entering the trade, you already know:

Maximum possible profit

Maximum possible loss

Breakeven range

This makes it a mentally comfortable strategy

At share trading classes in Nagpur

Position sizing

Risk per trade

Capital allocation

Iron Condor vs Directional Trading Many beginners ask:

Here’s the reality:

Directional trading:

Requires strong market movement

Suffers from time decay

Low success ratio for beginners

Iron Condor:

Does not need big movement

Uses time decay in your favor

Higher probability when executed correctly

This shift in mindset is what separates gamblers from trained traders.

Common Mistakes Traders Make in Iron Condor Even good strategies fail if executed poorly. Some common mistakes include:

Trading during high-impact news

Keeping strike prices too close

Ignoring volatility levels

Overtrading without risk control

Holding losing positions emotionally

Professional share market classes in Nagpur process-driven trading , not just strategy names.

Role of Volatility in Iron Condor Volatility plays a crucial role in Iron Condor performance.

High volatility = wider premiums but higher risk

Low volatility = safer but smaller returns

Smart traders enter Iron Condors:

After volatility expansion

When volatility starts cooling down

Understanding volatility is a non-negotiable skill taught in structured share market training in Nagpur

Iron Condor on Index vs Stock Options Most traders prefer index options for Iron Condor because:

Better liquidity

No individual stock risk

Predictable behavior

Stock options can be used but require:

Deep understanding of company fundamentals

Awareness of results and news

That’s why beginners are usually guided towards NIFTY and BANK NIFTY strategies in professional training programs.

Adjustment Techniques in Iron Condor Markets don’t always behave perfectly. Sometimes adjustments are needed.

Adjustments may include:

Shifting one side of the condor

Closing threatened leg early

Reducing risk exposure

Converting strategy structure

However, adjustments should be rule-based, not emotional.guided practice , not random trading.

Who Should Learn the Iron Condor Strategy? Iron Condor is suitable for:

Working professionals

Part-time traders

Traders who prefer consistency

Traders with limited screen time

It may not suit:

Scalpers

High-risk aggressive traders

Traders seeking fast intraday action

Choosing the right strategy based on personality is a major topic in quality stock market training .

Learning Iron Condor the Right Way Watching random videos or copying trades is dangerous in options trading.

To truly understand Iron Condor, one needs:

Strong basics of options

Greeks understanding

Risk management knowledge

Real-market examples

Mentored learning approach

This is exactly what structured share market course in Nagpur

Why Learn Options Strategies from Stock Market Vidya, Nagpur Stock Market Vidya is a well-known share market training institute in Nagpur , led by Mr. Prashant Sarode, a NISM Certified Trainer.

What makes the learning approach different:

Concepts explained in simple language

Practical market-focused teaching

Strategy + mindset + discipline approach

Whether you are searching for share market course near me or looking for the Best share market classes in Nagpur

Iron Condor as Part of a Professional Trading Plan Iron Condor is not a “magic strategy”.

Used as part of a diversified approach

Combined with volatility understanding

Executed with patience and rules

Professional traders treat it as a tool , not a shortcut.

Final Thoughts: Master Strategy, Not Just Signals

The Iron Condor Strategy teaches traders one powerful lesson:

You don’t need to predict the market to make money — you need to understand it.

If you want to move beyond guesswork and build structured trading knowledge, learning strategies like Iron Condor with proper guidance makes a real difference.

Contact – Stock Market Vidya, Nagpur

Mobile: 9822718163 / 8421893845 Website: www.stockmarketvidya.com

[{"id":708,"link":"https:\/\/stockmarketvidya.com\/blogs\/iron-condor-strategy-explained-learn-smart-options-trading-the-right-way\/","name":"iron-condor-strategy-explained-learn-smart-options-trading-the-right-way","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/02\/Iron-Condor-Strategy-Explained-\u2013-1.jpg","alt":"Iron Condor Strategy Explained"},"title":"Iron Condor Strategy Explained \u2013 Learn Smart Options Trading the Right Way","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Feb 5, 2026","dateGMT":"2026-02-05 01:17:00","modifiedDate":"2026-02-04 15:19:56","modifiedDateGMT":"2026-02-04 15:19:56","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/advanced-options-trading\/' rel='post_tag'>Advanced Options Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bank-nifty-iron-condor\/' rel='post_tag'>BANK NIFTY Iron Condor<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/iron-condor-options-trading\/' rel='post_tag'>Iron Condor Options Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/iron-condor-strategy\/' rel='post_tag'>iron condor strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nifty-iron-condor\/' rel='post_tag'>NIFTY Iron Condor<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nism-certified-trainer\/' rel='post_tag'>NISM Certified Trainer<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/non-directional-options-strategy\/' rel='post_tag'>Non Directional Options Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/option-selling-strategies\/' rel='post_tag'>Option Selling Strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-selling-strategy\/' rel='post_tag'>Options selling strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-course\/' rel='post_tag'>options trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/professional-options-trading\/' rel='post_tag'>professional options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/risk-managed-trading\/' rel='post_tag'>Risk Managed Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes-in-nagpur\/' rel='post_tag'>Share Market Classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training-nagpur\/' rel='post_tag'>stock market training Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/theta-decay-strategy\/' rel='post_tag'>Theta Decay Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/volatility-trading\/' rel='post_tag'>Volatility Trading<\/a>"},"readTime":{"min":5,"sec":57},"status":"publish","excerpt":""},{"id":704,"link":"https:\/\/stockmarketvidya.com\/blogs\/iron-collar-strategy-explained-smart-risk-control-options-strategy-for-indian-traders\/","name":"iron-collar-strategy-explained-smart-risk-control-options-strategy-for-indian-traders","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/02\/Iron-Collar-Strategy-Explained.jpg","alt":"Iron Collar Strategy Explained: Smart Risk Control Options Strategy for Indian Traders"},"title":"Iron Collar Strategy Explained: Smart Risk Control Options Strategy for Indian Traders","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Feb 3, 2026","dateGMT":"2026-02-03 10:48:33","modifiedDate":"2026-02-03 10:48:34","modifiedDateGMT":"2026-02-03 10:48:34","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/advanced-options-strategies\/' rel='post_tag'>Advanced Options Strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/capital-protection-strategy\/' rel='post_tag'>capital protection strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/defined-risk-trading\/' rel='post_tag'>defined risk trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/hedged-options-trading\/' rel='post_tag'>hedged options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/indian-stock-market-options\/' rel='post_tag'>Indian stock market options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/iron-collar-options-strategy\/' rel='post_tag'>iron collar options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/iron-collar-strategy\/' rel='post_tag'>iron collar strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/limited-risk-options-strategy\/' rel='post_tag'>limited risk options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/option-selling-strategy\/' rel='post_tag'>option selling strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-hedging-strategy\/' rel='post_tag'>options hedging strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-course-nagpur\/' rel='post_tag'>options trading course Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-in-india\/' rel='post_tag'>Options Trading in India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/prashant-sarode-nism-certified\/' rel='post_tag'>Prashant Sarode NISM certified<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/professional-options-trading\/' rel='post_tag'>professional options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/risk-control-in-options-trading\/' rel='post_tag'>risk control in options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/rule-based-trading\/' rel='post_tag'>rule based trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/sideways-market-options-strategy\/' rel='post_tag'>sideways market options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/smart-options-trading\/' rel='post_tag'>smart options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course-in-nagpur\/' rel='post_tag'>stock market course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya-nagpur\/' rel='post_tag'>Stock Market Vidya Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-options-trading\/' rel='post_tag'>stock options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/trading-psychology\/' rel='post_tag'>Trading Psychology<\/a>"},"readTime":{"min":5,"sec":58},"status":"publish","excerpt":""},{"id":696,"link":"https:\/\/stockmarketvidya.com\/blogs\/bear-put-spread-strategy-explained-a-smart-options-trading-method-for-falling-markets\/","name":"bear-put-spread-strategy-explained-a-smart-options-trading-method-for-falling-markets","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/Bear-Put-Spread-Strategy-Explained.jpg","alt":"Bear Put Spread Strategy - Stock Marketing Training Nagpur"},"title":"Bear Put Spread Strategy Explained: A Smart Options Trading Method for Falling Markets","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 31, 2026","dateGMT":"2026-01-31 01:00:00","modifiedDate":"2026-01-30 14:47:36","modifiedDateGMT":"2026-01-30 14:47:36","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bank-nifty-options\/' rel='post_tag'>Bank Nifty options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bear-put-spread\/' rel='post_tag'>Bear Put Spread<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bear-put-spread-strategy\/' rel='post_tag'>Bear Put Spread Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bearish-options-strategy\/' rel='post_tag'>Bearish Options Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nifty-options-strategy\/' rel='post_tag'>Nifty Options Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-basics\/' rel='post_tag'>Options trading basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/professional-trading-strategies\/' rel='post_tag'>Professional Trading Strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya\/' rel='post_tag'>Stock Market Vidya<\/a>"},"readTime":{"min":9,"sec":19},"status":"publish","excerpt":""},{"id":689,"link":"https:\/\/stockmarketvidya.com\/blogs\/covered-call-strategy-explained-how-indian-traders-earn-regular-income-from-the-stock-market\/","name":"covered-call-strategy-explained-how-indian-traders-earn-regular-income-from-the-stock-market","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/The-investment-guide-Learn-about-how-to-deal-with-the-crisis-Learn-about-how-to-analyze-opportunities.jpg","alt":"Covered Call Strategy Explained"},"title":"Covered Call Strategy Explained: How Indian Traders Earn Regular Income from the Stock Market","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 29, 2026","dateGMT":"2026-01-29 05:20:19","modifiedDate":"2026-01-29 05:23:02","modifiedDateGMT":"2026-01-29 05:23:02","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/covered-call-options\/' rel='post_tag'>Covered Call Options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/covered-call-strategy\/' rel='post_tag'>Covered Call Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/income-strategy-in-stock-market\/' rel='post_tag'>Income Strategy in Stock Market<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nism-certified-trainer\/' rel='post_tag'>NISM Certified Trainer<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-india\/' rel='post_tag'>Options trading India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/prashant-sarode\/' rel='post_tag'>Prashant Sarode<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya-nagpur\/' rel='post_tag'>Stock Market Vidya Nagpur<\/a>"},"readTime":{"min":9,"sec":36},"status":"publish","excerpt":""},{"id":677,"link":"https:\/\/stockmarketvidya.com\/blogs\/bear-call-spread-strategy-explained-a-smart-options-trading-method-for-sideways-to-falling-markets\/","name":"bear-call-spread-strategy-explained-a-smart-options-trading-method-for-sideways-to-falling-markets","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/Bear-Call-Spread-Strategy11.jpg","alt":"Bear-Call-Spread-Strategy"},"title":"Bear Call Spread Strategy Explained: A Smart Options Trading Method for Sideways to Falling Markets","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 24, 2026","dateGMT":"2026-01-24 12:21:15","modifiedDate":"2026-01-27 10:12:22","modifiedDateGMT":"2026-01-27 10:12:22","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/advanced-options-strategies\/' rel='post_tag'>Advanced Options Strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bear-call-spread\/' rel='post_tag'>Bear Call Spread<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bear-call-spread-strategy\/' rel='post_tag'>Bear Call Spread Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bearish-market-strategy\/' rel='post_tag'>Bearish Market Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bearish-options-strategy\/' rel='post_tag'>Bearish Options Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/call-option-selling\/' rel='post_tag'>Call Option Selling<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/credit-spread-strategy\/' rel='post_tag'>Credit spread strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/derivatives-trading\/' rel='post_tag'>Derivatives Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nism-options-trading\/' rel='post_tag'>NISM Options Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/option-spread-strategy\/' rel='post_tag'>Option Spread Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-course\/' rel='post_tag'>options trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-in-india\/' rel='post_tag'>Options Trading in India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/risk-limited-strategy\/' rel='post_tag'>Risk Limited Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes-in-nagpur\/' rel='post_tag'>Share Market Classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-options\/' rel='post_tag'>Stock Market Options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya\/' rel='post_tag'>Stock Market Vidya<\/a>"},"readTime":{"min":6,"sec":22},"status":"publish","excerpt":""},{"id":672,"link":"https:\/\/stockmarketvidya.com\/blogs\/what-is-a-bull-put-spread-simple-explanation-with-real-market-logic\/","name":"what-is-a-bull-put-spread-simple-explanation-with-real-market-logic","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/What-Is-a-Bull-Put-Spread.jpg","alt":"What Is a Bull Put Spread? share trading classes in Nagpur"},"title":"What Is a Bull Put Spread? Simple Explanation with Real-Market Logic","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 22, 2026","dateGMT":"2026-01-22 13:01:24","modifiedDate":"2026-01-22 13:08:10","modifiedDateGMT":"2026-01-22 13:08:10","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bank-nifty-options\/' rel='post_tag'>Bank Nifty options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-put-spread\/' rel='post_tag'>Bull Put Spread<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-put-spread-explained\/' rel='post_tag'>Bull Put Spread explained<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-put-spread-strategy\/' rel='post_tag'>Bull Put Spread strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/credit-spread-strategy\/' rel='post_tag'>Credit spread strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/index-options-trading\/' rel='post_tag'>Index options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/indian-stock-market-training\/' rel='post_tag'>Indian stock market training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/learn-options-trading\/' rel='post_tag'>Learn options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/low-risk-options-strategy\/' rel='post_tag'>low risk options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nifty-options-trading\/' rel='post_tag'>Nifty options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-selling-strategy\/' rel='post_tag'>Options selling strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-basics\/' rel='post_tag'>Options trading basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-classes-in-nagpur\/' rel='post_tag'>options trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-india\/' rel='post_tag'>Options trading India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/put-option-strategy\/' rel='post_tag'>Put option strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-near-me\/' rel='post_tag'>share market course near me<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-education-india\/' rel='post_tag'>stock market education India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/what-is-bull-put-spread\/' rel='post_tag'>What is Bull Put Spread<\/a>"},"readTime":{"min":6,"sec":20},"status":"publish","excerpt":""},{"id":663,"link":"https:\/\/stockmarketvidya.com\/blogs\/top-10-popular-world-indices-every-trader-and-investor-must-know\/","name":"top-10-popular-world-indices-every-trader-and-investor-must-know","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/Top-10-Popular-World-Indices-Every-Trader-and-Investor-Must-Know.jpg","alt":"Top 10 Popular World Indices Every Trader and Investor Must Know Nagpur"},"title":"Top 10 Popular World Indices Every Trader and Investor Must Know","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 18, 2026","dateGMT":"2026-01-18 11:19:58","modifiedDate":"2026-01-18 11:44:32","modifiedDateGMT":"2026-01-18 11:44:32","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/dax-index\/' rel='post_tag'>DAX index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/dow-jones-index\/' rel='post_tag'>Dow Jones index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/ftse-100-index\/' rel='post_tag'>FTSE 100 index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/global-indices-impact-on-indian-market\/' rel='post_tag'>global indices impact on Indian market<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/global-market-indices\/' rel='post_tag'>global market indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/global-stock-indices\/' rel='post_tag'>global stock indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/global-stock-market-for-beginners\/' rel='post_tag'>global stock market for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/hang-seng-index\/' rel='post_tag'>Hang Seng index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/international-stock-indices\/' rel='post_tag'>international stock indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/major-world-indices\/' rel='post_tag'>major world indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/msci-world-index\/' rel='post_tag'>MSCI World Index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nasdaq-index\/' rel='post_tag'>Nasdaq index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nifty-vs-global-indices\/' rel='post_tag'>Nifty vs global indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nikkei-225-index\/' rel='post_tag'>Nikkei 225 index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/popular-world-indices\/' rel='post_tag'>popular world indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/prashant-sarode\/' rel='post_tag'>Prashant Sarode<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/sp-500-index\/' rel='post_tag'>S&P 500 index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/sensex-global-comparison\/' rel='post_tag'>Sensex global comparison<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-learning\/' rel='post_tag'>share market learning<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-basics\/' rel='post_tag'>stock market basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-education\/' rel='post_tag'>Stock market education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training-institute\/' rel='post_tag'>stock market training institute<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya-nagpur\/' rel='post_tag'>Stock Market Vidya Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/top-global-indices\/' rel='post_tag'>top global indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/world-indices-explained\/' rel='post_tag'>world indices explained<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/world-indices-for-indian-traders\/' rel='post_tag'>world indices for Indian traders<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/world-stock-market-indices\/' rel='post_tag'>world stock market indices<\/a>"},"readTime":{"min":6,"sec":2},"status":"publish","excerpt":""},{"id":659,"link":"https:\/\/stockmarketvidya.com\/blogs\/is-bull-call-spread-profitable-risk-controlled-options-strategy-explained\/","name":"is-bull-call-spread-profitable-risk-controlled-options-strategy-explained","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/Is-Bull-Call-Spread-Profitable.jpg","alt":"Is Bull Call Spread Profitable"},"title":"Is Bull Call Spread Profitable? Risk-Controlled Options Strategy Explained","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 15, 2026","dateGMT":"2026-01-15 16:44:15","modifiedDate":"2026-01-15 16:53:24","modifiedDateGMT":"2026-01-15 16:53:24","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/beginner-options-trading-strategy\/' rel='post_tag'>beginner options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-calculation\/' rel='post_tag'>Bull Call Spread calculation<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-example\/' rel='post_tag'>Bull Call Spread example<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-explained\/' rel='post_tag'>Bull Call Spread explained<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-for-beginners\/' rel='post_tag'>Bull Call Spread for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-in-options-trading\/' rel='post_tag'>Bull Call Spread in options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-option-chain-example\/' rel='post_tag'>Bull Call Spread option chain example<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-options-strategy\/' rel='post_tag'>Bull Call Spread options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-payoff-explanation\/' rel='post_tag'>Bull Call Spread payoff explanation<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-profit-and-loss\/' rel='post_tag'>Bull Call Spread profit and loss<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-strategy\/' rel='post_tag'>Bull Call Spread strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-strategy-for-bank-nifty\/' rel='post_tag'>Bull Call Spread strategy for Bank Nifty<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-strategy-for-nifty\/' rel='post_tag'>Bull Call Spread strategy for Nifty<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-strategy-in-india\/' rel='post_tag'>Bull Call Spread strategy in India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-vs-long-call\/' rel='post_tag'>Bull Call Spread vs Long Call<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bullish-options-strategy\/' rel='post_tag'>bullish options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/call-option-strategies\/' rel='post_tag'>call option strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/how-bull-call-spread-works\/' rel='post_tag'>How Bull Call Spread works<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/is-bull-call-spread-profitable\/' rel='post_tag'>Is Bull Call Spread profitable<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/low-risk-options-strategy\/' rel='post_tag'>low risk options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nism-certified-stock-market-trainer\/' rel='post_tag'>NISM certified stock market trainer<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/option-spread-strategies\/' rel='post_tag'>option spread strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-classes-in-nagpur\/' rel='post_tag'>options trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-course\/' rel='post_tag'>options trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/risk-defined-options-strategy\/' rel='post_tag'>risk defined options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-near-me\/' rel='post_tag'>share market course near me<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/what-is-bull-call-spread\/' rel='post_tag'>What is Bull Call Spread<\/a>"},"readTime":{"min":6,"sec":18},"status":"publish","excerpt":""},{"id":646,"link":"https:\/\/stockmarketvidya.com\/blogs\/how-to-start-commodity-trading-in-india-with-small-capital-a-practical-learning-guide-for-smart-beginners\/","name":"how-to-start-commodity-trading-in-india-with-small-capital-a-practical-learning-guide-for-smart-beginners","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/How-to-Start-Commodity-Trading-in-India-with-Small-Capital.jpg","alt":"How to Start Commodity Trading in India with Small Capital: A Practical Learning Guide for Smart Beginners in Nagpur"},"title":"How to Start Commodity Trading in India with Small Capital: A Practical Learning Guide for Smart Beginners","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 10, 2026","dateGMT":"2026-01-10 14:54:33","modifiedDate":"2026-01-10 15:02:49","modifiedDateGMT":"2026-01-10 15:02:49","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-futures-trading\/' rel='post_tag'>commodity futures trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-market-india\/' rel='post_tag'>commodity market India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-options-trading\/' rel='post_tag'>commodity options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading\/' rel='post_tag'>commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-basics\/' rel='post_tag'>commodity trading basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-classes\/' rel='post_tag'>commodity trading classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-course\/' rel='post_tag'>commodity trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-education\/' rel='post_tag'>commodity trading education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-for-beginners\/' rel='post_tag'>commodity trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-in-india\/' rel='post_tag'>commodity trading in India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-strategies\/' rel='post_tag'>commodity trading strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-with-small-capital\/' rel='post_tag'>commodity trading with small capital<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/derivative-trading-india\/' rel='post_tag'>derivative trading India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/how-to-start-commodity-trading\/' rel='post_tag'>how to start commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/mcx-commodity-trading\/' rel='post_tag'>MCX commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/ncdex-commodity-trading\/' rel='post_tag'>NCDEX commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/online-commodity-trading\/' rel='post_tag'>online commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-near-me\/' rel='post_tag'>share market course near me<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/trading-education-india\/' rel='post_tag'>trading education india<\/a>"},"readTime":{"min":5,"sec":48},"status":"publish","excerpt":""},{"id":638,"link":"https:\/\/stockmarketvidya.com\/blogs\/what-does-gift-nifty-indicate-before-market-opens-in-india-a-traders-pre-market-compass\/","name":"what-does-gift-nifty-indicate-before-market-opens-in-india-a-traders-pre-market-compass","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/What-Does-Gift-Nifty-Indicate-Before-Market-Opens-in-India.jpg","alt":"What Does Gift Nifty Indicate Before Market Opens in India? A Trader\u2019s Pre-Market Compass"},"title":"What Does Gift Nifty Indicate Before Market Opens in India? A Trader\u2019s Pre-Market Compass","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 8, 2026","dateGMT":"2026-01-08 11:48:11","modifiedDate":"2026-01-08 11:50:08","modifiedDateGMT":"2026-01-08 11:50:08","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":6,"sec":29},"status":"publish","excerpt":""},{"id":632,"link":"https:\/\/stockmarketvidya.com\/blogs\/what-is-currency-trading-a-simple-guide-for-indian-beginners\/","name":"what-is-currency-trading-a-simple-guide-for-indian-beginners","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/What-Is-Currency-Trading.jpg","alt":"What Is Currency Trading? Currency Trading Course in Nagpur"},"title":"What Is Currency Trading? A Simple Guide for Indian Beginners","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 6, 2026","dateGMT":"2026-01-06 16:15:28","modifiedDate":"2026-01-06 16:16:56","modifiedDateGMT":"2026-01-06 16:16:56","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/currency-trading\/\" rel=\"category tag\">Currency Trading<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/currency-trading\/\" rel=\"category tag\">Currency Trading<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":6,"sec":30},"status":"publish","excerpt":""},{"id":621,"link":"https:\/\/stockmarketvidya.com\/blogs\/how-crypto-trading-works-understanding-bitcoin-altcoins-and-market-trends\/","name":"how-crypto-trading-works-understanding-bitcoin-altcoins-and-market-trends","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/How-Crypto-Trading-Works.jpg","alt":"How Crypto Trading Works: Crypto Trading Course in Nagpur"},"title":"How Crypto Trading Works: Understanding Bitcoin, Altcoins, and Market Trends","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 3, 2026","dateGMT":"2026-01-03 08:09:45","modifiedDate":"2026-01-03 08:30:32","modifiedDateGMT":"2026-01-03 08:30:32","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/crypto-trading\/\" rel=\"category tag\">Crypto Trading<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/crypto-trading\/\" rel=\"category tag\">Crypto Trading<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/altcoin-trading\/' rel='post_tag'>altcoin trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bitcoin-and-altcoins\/' rel='post_tag'>bitcoin and altcoins<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bitcoin-trading\/' rel='post_tag'>bitcoin trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-market-trends\/' rel='post_tag'>crypto market trends<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-risk-management\/' rel='post_tag'>crypto risk management<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-technical-analysis\/' rel='post_tag'>crypto technical analysis<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading\/' rel='post_tag'>crypto trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-basics\/' rel='post_tag'>crypto trading basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-classes\/' rel='post_tag'>crypto trading classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-course\/' rel='post_tag'>crypto trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-education\/' rel='post_tag'>crypto trading education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-for-beginners\/' rel='post_tag'>crypto trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-psychology\/' rel='post_tag'>crypto trading psychology<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-training\/' rel='post_tag'>crypto trading training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/cryptocurrency-trading\/' rel='post_tag'>cryptocurrency trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/financial-market-training\/' rel='post_tag'>financial market training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/how-crypto-trading-works\/' rel='post_tag'>how crypto trading works<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/learn-crypto-trading\/' rel='post_tag'>learn crypto trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-education\/' rel='post_tag'>Stock market education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/trading-education-in-india\/' rel='post_tag'>trading education in India<\/a>"},"readTime":{"min":6,"sec":31},"status":"publish","excerpt":""}]