In the dynamic world of the stock market, every trader and investor faces one big question: Should I follow Fundamental Analysis or Technical Analysis?

Both approaches promise success, both are backed by strong logic, and both have helped traders earn profits. But the real question is — which one works better for you?

At Stock Market Vidya, Nagpur, guided by Mr. Prashant Sarode, an NISM Certified Trainer, students learn how to decode both these trading techniques practically. Whether you are a beginner or an active trader, understanding the difference between Fundamental and Technical Analysis can help you make smarter decisions and build confidence in your trading journey.

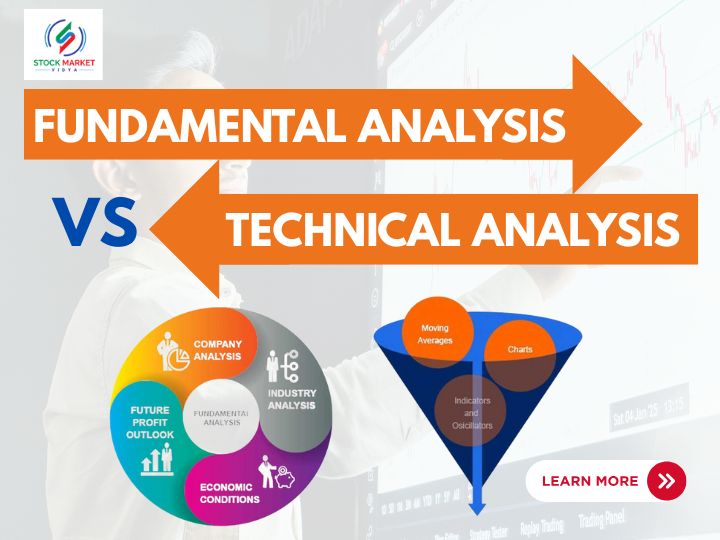

1. The Two Pillars of Market Analysis

Before you dive deep into trading, it’s important to understand the foundation. The market is driven by two main analytical approaches: Fundamental Analysis and Technical Analysis.

- Fundamental Analysis looks at the real value of a company. It studies earnings, management, future growth, and financial health to decide whether a stock is undervalued or overvalued.

- Technical Analysis, on the other hand, focuses on price movements and trends. It studies charts, indicators, and patterns to predict where the price might move next.

Both aim to help you make profitable decisions — but their paths are completely different.

2. Understanding Fundamental Analysis in Detail

Fundamental Analysis is like understanding the heart of a company. You’re not just looking at the stock price; you’re analyzing the entire business behind it.

a. The Core Concept

The main idea behind Fundamental Analysis is simple — every stock has an intrinsic value. If the market price is lower than its real worth, it’s a buying opportunity. If it’s higher, it’s time to stay away or sell.

b. Key Components

- Earnings and Profit Growth – The stronger a company’s profits, the healthier its fundamentals.

- Revenue Trends – Increasing revenue shows growing demand and good management performance.

- Debt and Liabilities – A financially strong company has manageable debt levels.

- Industry Analysis – How the company performs in comparison to competitors in its sector.

- Management Quality – Leadership plays a major role in long-term success.

- Economic Conditions – Inflation, interest rates, and government policies impact stock performance.

c. The Objective

A fundamental analyst’s goal is to find long-term investment opportunities. They buy undervalued stocks and hold them until they reach their true value — often for months or years.

d. Who Should Use It

Fundamental Analysis suits investors, not short-term traders. If you believe in value investing like Warren Buffett, this approach will help you choose strong companies for your portfolio.

3. Exploring Technical Analysis in Depth

Technical Analysis is all about studying price behavior and market psychology. It assumes that everything — news, fundamentals, and investor emotions — is already reflected in the price.

a. The Core Concept

Technical Analysis doesn’t ask why the price moves. It focuses on how and when it moves.

By using charts, patterns, and indicators, traders identify entry and exit points for buying or selling.

b. Key Tools and Indicators

- Candlestick Patterns – Visual representation of price movement that reveals trends and reversals.

- Moving Averages (MA) – Help identify trend direction and potential changes.

- Relative Strength Index (RSI) – Shows overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence) – Helps catch momentum and trend strength.

- Support and Resistance Levels – Mark crucial points where prices bounce or break out.

- Volume Analysis – Confirms the strength behind a price move.

c. The Objective

Technical analysts aim for timing and precision. They don’t wait for years — they look for opportunities that can deliver returns in days, weeks, or months.

d. Who Should Use It

If you are an active trader, love studying charts, and want to capture short-term profits, Technical Analysis is your arena.

4. Time Horizon: Long-Term vs Short-Term

The biggest difference between both analyses is the time frame.

- Fundamental Analysis looks at the big picture. Investors using this method think in terms of years — focusing on business performance and economic trends.

- Technical Analysis is short-term. Traders react to price actions daily, weekly, or even hourly.

If you enjoy long-term wealth creation, Fundamental Analysis might suit you. But if you enjoy fast market action and short-term trades, Technical Analysis will keep you engaged.

5. Decision-Making Style: Logic vs Psychology

Both analyses rely on different aspects of human thinking.

- Fundamental Analysis = Logic and Data.

You depend on financial reports, earnings statements, and real numbers. - Technical Analysis = Psychology and Pattern Recognition.

You rely on understanding crowd behavior and price emotions.

At Stock Market Vidya Nagpur, students are trained to balance both — combining the logic of fundamentals with the timing of technicals to make well-rounded decisions.

6. Real-World Example: Comparing Two Approaches

Let’s take an example — suppose you are analyzing Infosys.

- A Fundamental Analyst will study its quarterly reports, revenue growth, and IT sector outlook before investing. They believe the company’s strong fundamentals will increase the stock price in the long run.

- A Technical Analyst, however, will open the chart, study RSI, moving averages, and look for a breakout pattern before entering the trade. They believe short-term momentum will decide profit.

Both can make money — but only if they apply their methods with discipline.

7. Strengths and Weaknesses

Both approaches have their own advantages and challenges:

Strengths of Fundamental Analysis

- Helps you understand the business deeply.

- Ideal for building a strong investment portfolio.

- Less affected by short-term market volatility.

- Helps in identifying undervalued gems early.

Weaknesses

- Time-consuming — requires studying multiple reports and data.

- Not suitable for quick profits.

- Market irrationality can delay results.

Strengths of Technical Analysis

- Quick to apply with real-time data.

- Works well in volatile markets.

- Helps identify precise entry and exit points.

- Suitable for short-term and intraday trading.

Weaknesses

- Can be misleading without confirmation from other tools.

- Over-analysis can lead to confusion (analysis paralysis).

- Works best with discipline and strict risk management.

8. Why Not Combine Both? The Hybrid Approach

Many successful traders today don’t pick sides — they combine both.

This approach is known as Techno-Fundamental Analysis.

For example, an investor might use Fundamental Analysis to shortlist strong companies and then use Technical Analysis to decide when to buy.

At Stock Market Vidya Nagpur, this hybrid method is taught practically through live market sessions, chart reading practice, and company case studies. Students learn how to connect the dots between value and timing.

9. Choosing the Right Path for You

The right analysis style depends on your personality, trading goals, and time availability.

Ask yourself these questions:

- Do you enjoy studying financial reports and long-term trends? Then choose Fundamental Analysis.

- Do you love observing charts and quick market moves? Then Technical Analysis will excite you.

- Do you want a balanced strategy for both trading and investing? Learn to combine both.

With proper share market training in Nagpur, you can discover which strategy aligns best with your mindset.

10. Learning from Experts Makes the Difference

Theory alone is not enough. You must practice and understand how both analyses behave in real-time.

Under the mentorship of Mr. Prashant Sarode at Stock Market Vidya, students experience the real power of market education. Through practical sessions, interactive discussions, and real market examples, learners master both analytical approaches.

Whether you want to become a long-term investor or an active trader, joining share trading classes in Nagpur will guide you toward a structured learning path.

11. Building Confidence Through Structured Learning

When you enroll in a stock market course, you don’t just learn theories — you build confidence. You start reading the market with clarity, make data-driven decisions, and avoid emotional mistakes.

Stock Market Vidya’s structured training helps you:

- Understand the foundation of market analysis.

- Learn how to apply both methods in real trading conditions.

- Build your own trading strategy based on your goals.

- Manage risks effectively while maximizing returns.

That’s why it’s recognized among the Best share market classes in Nagpur — combining knowledge, experience, and hands-on learning.

12. Final Thoughts: Which Works Better for You?

There is no universal answer to this question.

Both Fundamental and Technical Analysis work — but only when you understand how to use them properly.

- If your goal is wealth creation, Fundamental Analysis can help you identify solid companies.

- If your goal is active income, Technical Analysis gives you the tools to time the market.

- And if your goal is complete mastery, learn both under expert mentorship.

Trading is not about choosing one side — it’s about understanding the balance. The deeper your knowledge, the better your results.

Conclusion

The stock market rewards those who learn, adapt, and stay disciplined.

At Stock Market Vidya, Nagpur, under the guidance of Mr. Prashant Sarode, you’ll gain real-world skills in both Fundamental and Technical Analysis.

Join share trading classes in Nagpur today and take your first step toward confident and successful trading.

Contact: 9822718163, 8421893845

Website: www.stockmarketvidya.com