By Stock Market Vidya, Nagpur | Mr. Prashant Sarode

Are you trying to predict the next big move in the stock market? Wondering what candles on a chart are trying to tell you?

Welcome to the secret code of trading – Candlestick Patterns .

If you’re serious about learning to trade, mastering candlestick patterns is not optional – it’s essential. These tiny shapes and wicks on your trading chart hold the power to tell you the market’s story – whether it’s fear, greed, reversal, or momentum. And this blog is your visual guide to understanding them—step-by-step, with hand-drawn-style diagrams and real-world trading insights.

Whether you’re just beginning your journey through a stock market course share market training Stock Market Vidya , the best share market classes in Nagpur , is designed to make candlesticks your new best friend.

Let’s light the candle and start decoding!

Why Learn Candlestick Patterns? Candlestick patterns are not just historical data—they are reflections of market psychology. Every pattern reveals what buyers and sellers are doing and how momentum is shifting.

Candlesticks help you:

Identify potential entry and exit points

Read market mood in real-time

Build conviction before taking trades

Stay ahead of trends, reversals, and breakouts

If you’re enrolled in a share market course in Nagpur , this is the visual tool you must master.

Anatomy of a Candlestick (Before We Jump into Patterns) Before we dive into patterns, let’s quickly understand how to read a single candlestick.

Imagine a candle with a body and two wicks (shadows) sticking out from the top and bottom. That candle tells you four things for a given time period:

Open : Price at which the market openedHigh : Highest price during the sessionLow : Lowest priceClose : Final price of the session

If the close is higher than the open, it’s typically a green or white candle (bullish). If the close is lower, it’s a red or black candle (bearish).

Category 1: Single Candlestick Patterns – Simplicity with Power

1. Doji – Market Confusion at its Peak The Doji has almost no body – the open and close are nearly the same. It signals indecision and often precedes reversals.

When it appears at market tops or bottoms , traders prepare for trend changes.

Green – Bullish Reversal Doji at support

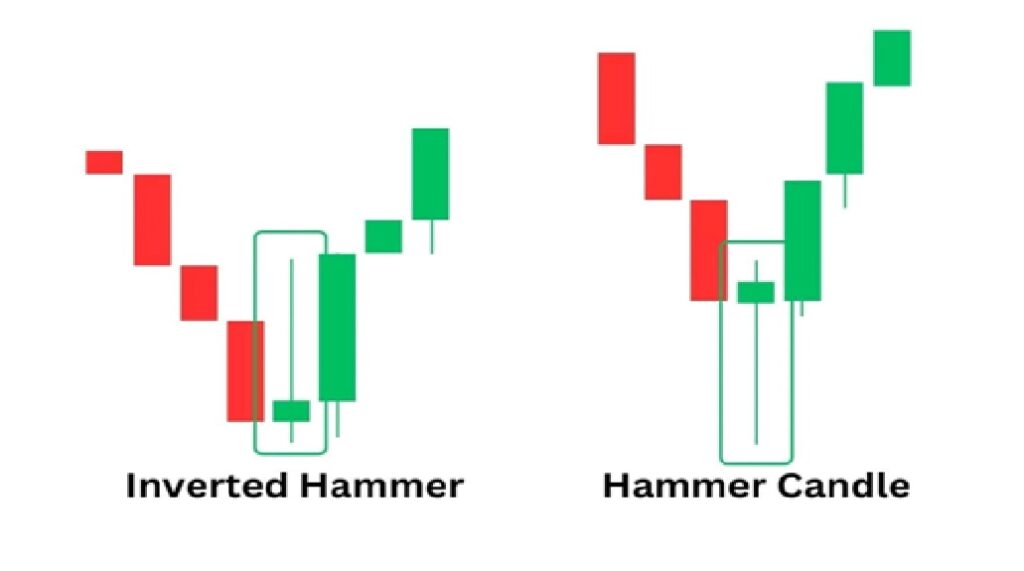

2. Hammer – Buyers Taking Control A hammer has a small body at the top with a long lower shadow.

It appears after a downtrend and suggests that buyers rejected lower prices and pulled it back up.

3. Inverted Hammer – Cautious Optimism This is like the hammer flipped upside-down. It also appears after a downtrend.

Its long upper wick shows that buyers tried to push prices up but faced resistance. Still, it’s often seen before a reversal.

4. Shooting Star – Warning of Fall Looks like an inverted hammer but appears at the top of an uptrend.

It signals buyer exhaustion and possible trend reversal.

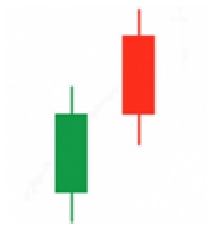

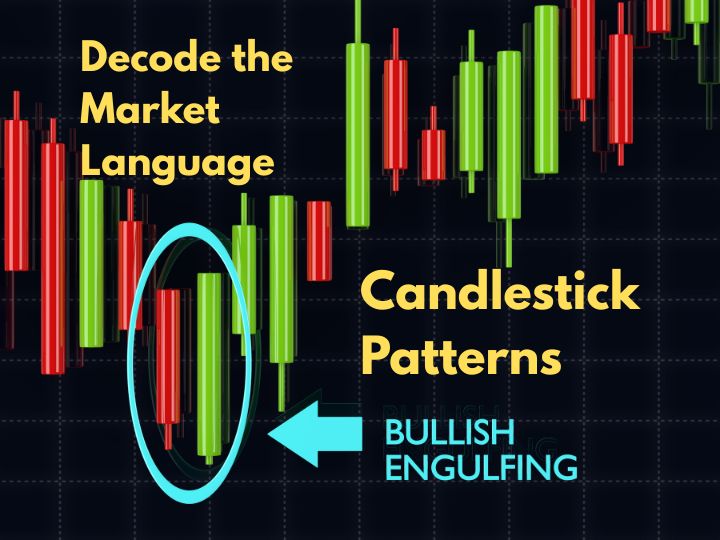

Category 2: Double Candlestick Patterns – When Two Candles Talk 1. Bullish Engulfing – Trend is Changing In this pattern, a small red candle is followed by a large green candle that completely engulfs the red one.

It indicates strong buying pressure.

Best used near support zones.

2. Bearish Engulfing – Trend May Fall Exactly opposite. A small green candle is followed by a big red candle that eats it up. If seen near resistance, this is often a warning to exit long positions.

3. Piercing Line – Buyers Fight Back First candle is red, second is green and opens lower but closes more than halfway into the red candle.

This shows buyers are ready to take control.

4. Dark Cloud Cover – Watch Your Longs First candle is green, second is red. The red candle opens higher but closes below the midpoint of the green candle.

It hints at a bearish reversal.

Category 3: Triple Candlestick Patterns – Powerful Price Confirmations 1. Morning Star – The Light After Darkness Three candles form this pattern:

Long red (bearish)

Small-bodied candle (could be red or green)

Strong green candle

Appears at the bottom of a downtrend. It’s a solid bullish reversal signal.

2. Evening Star – Sunset for Bulls Same as Morning Star, but in reverse:

Long green candle

Small candle

Strong red candle

Appears after an uptrend, indicating reversal.

3. Three White Soldiers – Bull Power Parade Three consecutive green candles with higher highs and higher closes.

Indicates a strong bullish momentum, often continuing for days.

4. Three Black Crows – Bear Army Incoming Three back-to-back red candles with lower lows and closes.

Indicates aggressive selling and potential downtrend.

How to Use These Patterns in Real Trading? Candlestick patterns are not stand-alone signals . Combine them with:

Support/resistance zones

Moving averages

RSI, MACD

Volume confirmation

In the stock market course at Stock Market Vidya, we teach how to mix patterns with technical analysis and price action for high-probability trades.

Case Study: How a Student Spotted a Winning Trade with Just Candles Ravi, a student from our share market course in Nagpur , spotted a Bullish Engulfing pattern on a PSU stock right at support.

Combined with RSI divergence and increasing volume, he entered the trade early. Within 5 sessions, the stock gave a 12% move.

Candlestick + Logic = Profit Potential

Tips to Master Candlestick Patterns

Don’t memorize—understand the psychology

Practice spotting patterns on historical charts

Use patterns with confirmation tools like RSI or volume

Avoid over-trading just because you see a pattern

Combine candles with share market training for maximum clarity

Why Learn This with Stock Market Vidya? At Stock Market Vidya, we don’t just teach theory. We help you see the story behind each candle . Whether you’re searching for share market course near me or aspiring to become a full-time trader, our stock market training blends practical learning with real-world insights.

Under the expert guidance of Mr. Prashant Sarode , our institute offers:

Hands-on technical charting sessions

Pattern recognition practice on live markets

Personalized guidance for learning pace

Call us today to know more:www.stockmarketvidya.com

Final Thought – Candlesticks Are the Market’s Voice. Are You Listening? Markets speak every moment. Through price, through volume, and especially through candles.

You don’t need hundreds of indicators. Just a few powerful candlestick patterns and some chart time can make all the difference in your trading journey.

If you’re ready to take your skills seriously and searching for the best share market classes in Nagpur , let candlestick mastery be your first step. Because charts never lie – and candles always whisper the truth.

Light the wick, follow the pattern, and let the profits follow.

Frequently Asked Questions (FAQs) 1. What are candlestick patterns in the stock market? Candlestick patterns are visual formations created by the price movements of stocks on a chart. Each candlestick shows the open, high, low, and close prices for a specific time frame. Patterns formed by one or more candlesticks can signal potential future price movements, helping traders make informed decisions.

2. Are candlestick patterns accurate for predicting market direction? Candlestick patterns are one of the most widely used tools in technical analysis. While no method is 100% accurate, when combined with support/resistance, volume, and momentum indicators, candlestick patterns provide high-probability trade setups . At Stock Market Vidya , we train students to use patterns effectively along with other trading tools.

3. Can beginners learn candlestick patterns easily? Yes, beginners can start learning candlestick patterns easily. Many patterns are visually intuitive and based on simple logic. With practice and guidance, even someone new to trading can spot reliable candlestick signals. Our share market classes

4. Which are the most powerful candlestick patterns? Some of the most powerful and frequently used candlestick patterns include:

Hammer Bullish Engulfing Morning Star Doji Shooting Star Three White Soldiers

These patterns are covered in detail with diagrams in our stock market course at Stock Market Vidya.

5. How many candlestick patterns are there in total? There are dozens of candlestick patterns, including single, double, and triple candle formations. However, traders often focus on 10 to 15 key patterns that appear frequently and offer strong signals. Our share market training program focuses on the most practical and effective ones for trading in Indian markets.

6. Can candlestick patterns be used for intraday trading? Absolutely. Candlestick patterns are very popular among intraday traders because they appear quickly and can be used on smaller time frames like 5-minute, 15-minute, or hourly charts. During our stock market training , we demonstrate real-time strategies using candlestick signals.

7. How long does it take to master candlestick patterns? While basic understanding can be achieved in a few sessions, mastery takes regular practice . With the right guidance and live chart practice, most learners start using candlestick patterns effectively within a few weeks. Our structured approach at Stock Market Vidya Nagpur helps learners progress quickly with confidence.

8. Do you teach candlestick patterns in your share market course? Yes. At Stock Market Vidya , candlestick patterns are a core part of our share market course in Nagpur

9. Is learning candlestick patterns enough to become a successful trader? Candlestick patterns are a great start, but successful trading also involves:

Understanding risk management

Reading market structure

Using volume and indicators

Emotional discipline

At Stock Market Vidya , we provide complete stock market training to cover all aspects of trading, not just patterns.

10. Where can I learn candlestick trading in Nagpur? You can learn professional candlestick trading at Stock Market Vidya , the best share market classes in Nagpur , led by expert trainer Mr. Prashant Sarode . Whether you’re a beginner or someone looking to upgrade your skills, our share market training program is tailored for all levels.

11. Do candlestick patterns work in all types of markets? Yes. Candlestick patterns are applicable in various markets such as:

Equity (stocks)

Futures

Options

Commodities

Forex

Cryptocurrencies

They are universal because they are based on price action, not asset type.

12. Do you provide hands-on practice on live charts? Yes, at Stock Market Vidya , we focus on practical learning. You’ll get hands-on training on live market charts , so you can spot and apply candlestick patterns in real time, not just in theory.

13. What tools or platforms are needed to practice candlestick patterns? You can use free charting platforms like TradingView , Chartink , or BSE/NSE terminals . In our stock market course , we guide students on how to set up their charts, choose the right time frames, and identify patterns using these tools efficiently.

14. What makes Stock Market Vidya the best place to learn candlestick trading?

Clear, step-by-step teaching style

Practical sessions using Indian stocks

Personalized chart analysis practice

Focus on market psychology behind each pattern

Experienced mentorship by Mr. Prashant Sarode

That’s why we’re recognized as the best share market classes in Nagpur .

15. How can I enroll in the candlestick training module at Stock Market Vidya? You can reach out directly to us:

Call/WhatsApp : 9822718163, 8421893845Visit : www.stockmarketvidya.com Batch Timing : Flexible weekday & weekend sessions available

Just mention you’re interested in candlestick pattern training, and our team will guide you with all details.

[{"id":708,"link":"https:\/\/stockmarketvidya.com\/blogs\/iron-condor-strategy-explained-learn-smart-options-trading-the-right-way\/","name":"iron-condor-strategy-explained-learn-smart-options-trading-the-right-way","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/02\/Iron-Condor-Strategy-Explained-\u2013-1.jpg","alt":"Iron Condor Strategy Explained"},"title":"Iron Condor Strategy Explained \u2013 Learn Smart Options Trading the Right Way","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Feb 5, 2026","dateGMT":"2026-02-05 01:17:00","modifiedDate":"2026-02-04 15:19:56","modifiedDateGMT":"2026-02-04 15:19:56","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/advanced-options-trading\/' rel='post_tag'>Advanced Options Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bank-nifty-iron-condor\/' rel='post_tag'>BANK NIFTY Iron Condor<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/iron-condor-options-trading\/' rel='post_tag'>Iron Condor Options Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/iron-condor-strategy\/' rel='post_tag'>iron condor strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nifty-iron-condor\/' rel='post_tag'>NIFTY Iron Condor<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nism-certified-trainer\/' rel='post_tag'>NISM Certified Trainer<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/non-directional-options-strategy\/' rel='post_tag'>Non Directional Options Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/option-selling-strategies\/' rel='post_tag'>Option Selling Strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-selling-strategy\/' rel='post_tag'>Options selling strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-course\/' rel='post_tag'>options trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/professional-options-trading\/' rel='post_tag'>professional options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/risk-managed-trading\/' rel='post_tag'>Risk Managed Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes-in-nagpur\/' rel='post_tag'>Share Market Classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training-nagpur\/' rel='post_tag'>stock market training Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/theta-decay-strategy\/' rel='post_tag'>Theta Decay Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/volatility-trading\/' rel='post_tag'>Volatility Trading<\/a>"},"readTime":{"min":5,"sec":57},"status":"publish","excerpt":""},{"id":704,"link":"https:\/\/stockmarketvidya.com\/blogs\/iron-collar-strategy-explained-smart-risk-control-options-strategy-for-indian-traders\/","name":"iron-collar-strategy-explained-smart-risk-control-options-strategy-for-indian-traders","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/02\/Iron-Collar-Strategy-Explained.jpg","alt":"Iron Collar Strategy Explained: Smart Risk Control Options Strategy for Indian Traders"},"title":"Iron Collar Strategy Explained: Smart Risk Control Options Strategy for Indian Traders","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Feb 3, 2026","dateGMT":"2026-02-03 10:48:33","modifiedDate":"2026-02-03 10:48:34","modifiedDateGMT":"2026-02-03 10:48:34","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/advanced-options-strategies\/' rel='post_tag'>Advanced Options Strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/capital-protection-strategy\/' rel='post_tag'>capital protection strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/defined-risk-trading\/' rel='post_tag'>defined risk trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/hedged-options-trading\/' rel='post_tag'>hedged options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/indian-stock-market-options\/' rel='post_tag'>Indian stock market options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/iron-collar-options-strategy\/' rel='post_tag'>iron collar options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/iron-collar-strategy\/' rel='post_tag'>iron collar strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/limited-risk-options-strategy\/' rel='post_tag'>limited risk options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/option-selling-strategy\/' rel='post_tag'>option selling strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-hedging-strategy\/' rel='post_tag'>options hedging strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-course-nagpur\/' rel='post_tag'>options trading course Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-in-india\/' rel='post_tag'>Options Trading in India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/prashant-sarode-nism-certified\/' rel='post_tag'>Prashant Sarode NISM certified<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/professional-options-trading\/' rel='post_tag'>professional options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/risk-control-in-options-trading\/' rel='post_tag'>risk control in options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/rule-based-trading\/' rel='post_tag'>rule based trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/sideways-market-options-strategy\/' rel='post_tag'>sideways market options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/smart-options-trading\/' rel='post_tag'>smart options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course-in-nagpur\/' rel='post_tag'>stock market course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya-nagpur\/' rel='post_tag'>Stock Market Vidya Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-options-trading\/' rel='post_tag'>stock options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/trading-psychology\/' rel='post_tag'>Trading Psychology<\/a>"},"readTime":{"min":5,"sec":58},"status":"publish","excerpt":""},{"id":696,"link":"https:\/\/stockmarketvidya.com\/blogs\/bear-put-spread-strategy-explained-a-smart-options-trading-method-for-falling-markets\/","name":"bear-put-spread-strategy-explained-a-smart-options-trading-method-for-falling-markets","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/Bear-Put-Spread-Strategy-Explained.jpg","alt":"Bear Put Spread Strategy - Stock Marketing Training Nagpur"},"title":"Bear Put Spread Strategy Explained: A Smart Options Trading Method for Falling Markets","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 31, 2026","dateGMT":"2026-01-31 01:00:00","modifiedDate":"2026-01-30 14:47:36","modifiedDateGMT":"2026-01-30 14:47:36","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bank-nifty-options\/' rel='post_tag'>Bank Nifty options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bear-put-spread\/' rel='post_tag'>Bear Put Spread<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bear-put-spread-strategy\/' rel='post_tag'>Bear Put Spread Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bearish-options-strategy\/' rel='post_tag'>Bearish Options Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nifty-options-strategy\/' rel='post_tag'>Nifty Options Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-basics\/' rel='post_tag'>Options trading basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/professional-trading-strategies\/' rel='post_tag'>Professional Trading Strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya\/' rel='post_tag'>Stock Market Vidya<\/a>"},"readTime":{"min":9,"sec":19},"status":"publish","excerpt":""},{"id":689,"link":"https:\/\/stockmarketvidya.com\/blogs\/covered-call-strategy-explained-how-indian-traders-earn-regular-income-from-the-stock-market\/","name":"covered-call-strategy-explained-how-indian-traders-earn-regular-income-from-the-stock-market","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/The-investment-guide-Learn-about-how-to-deal-with-the-crisis-Learn-about-how-to-analyze-opportunities.jpg","alt":"Covered Call Strategy Explained"},"title":"Covered Call Strategy Explained: How Indian Traders Earn Regular Income from the Stock Market","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 29, 2026","dateGMT":"2026-01-29 05:20:19","modifiedDate":"2026-01-29 05:23:02","modifiedDateGMT":"2026-01-29 05:23:02","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/covered-call-options\/' rel='post_tag'>Covered Call Options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/covered-call-strategy\/' rel='post_tag'>Covered Call Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/income-strategy-in-stock-market\/' rel='post_tag'>Income Strategy in Stock Market<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nism-certified-trainer\/' rel='post_tag'>NISM Certified Trainer<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-india\/' rel='post_tag'>Options trading India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/prashant-sarode\/' rel='post_tag'>Prashant Sarode<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya-nagpur\/' rel='post_tag'>Stock Market Vidya Nagpur<\/a>"},"readTime":{"min":9,"sec":36},"status":"publish","excerpt":""},{"id":677,"link":"https:\/\/stockmarketvidya.com\/blogs\/bear-call-spread-strategy-explained-a-smart-options-trading-method-for-sideways-to-falling-markets\/","name":"bear-call-spread-strategy-explained-a-smart-options-trading-method-for-sideways-to-falling-markets","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/Bear-Call-Spread-Strategy11.jpg","alt":"Bear-Call-Spread-Strategy"},"title":"Bear Call Spread Strategy Explained: A Smart Options Trading Method for Sideways to Falling Markets","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 24, 2026","dateGMT":"2026-01-24 12:21:15","modifiedDate":"2026-01-27 10:12:22","modifiedDateGMT":"2026-01-27 10:12:22","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/advanced-options-strategies\/' rel='post_tag'>Advanced Options Strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bear-call-spread\/' rel='post_tag'>Bear Call Spread<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bear-call-spread-strategy\/' rel='post_tag'>Bear Call Spread Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bearish-market-strategy\/' rel='post_tag'>Bearish Market Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bearish-options-strategy\/' rel='post_tag'>Bearish Options Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/call-option-selling\/' rel='post_tag'>Call Option Selling<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/credit-spread-strategy\/' rel='post_tag'>Credit spread strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/derivatives-trading\/' rel='post_tag'>Derivatives Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nism-options-trading\/' rel='post_tag'>NISM Options Trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/option-spread-strategy\/' rel='post_tag'>Option Spread Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-course\/' rel='post_tag'>options trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-in-india\/' rel='post_tag'>Options Trading in India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/risk-limited-strategy\/' rel='post_tag'>Risk Limited Strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes-in-nagpur\/' rel='post_tag'>Share Market Classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-options\/' rel='post_tag'>Stock Market Options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya\/' rel='post_tag'>Stock Market Vidya<\/a>"},"readTime":{"min":6,"sec":22},"status":"publish","excerpt":""},{"id":672,"link":"https:\/\/stockmarketvidya.com\/blogs\/what-is-a-bull-put-spread-simple-explanation-with-real-market-logic\/","name":"what-is-a-bull-put-spread-simple-explanation-with-real-market-logic","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/What-Is-a-Bull-Put-Spread.jpg","alt":"What Is a Bull Put Spread? share trading classes in Nagpur"},"title":"What Is a Bull Put Spread? Simple Explanation with Real-Market Logic","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 22, 2026","dateGMT":"2026-01-22 13:01:24","modifiedDate":"2026-01-22 13:08:10","modifiedDateGMT":"2026-01-22 13:08:10","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bank-nifty-options\/' rel='post_tag'>Bank Nifty options<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-put-spread\/' rel='post_tag'>Bull Put Spread<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-put-spread-explained\/' rel='post_tag'>Bull Put Spread explained<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-put-spread-strategy\/' rel='post_tag'>Bull Put Spread strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/credit-spread-strategy\/' rel='post_tag'>Credit spread strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/index-options-trading\/' rel='post_tag'>Index options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/indian-stock-market-training\/' rel='post_tag'>Indian stock market training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/learn-options-trading\/' rel='post_tag'>Learn options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/low-risk-options-strategy\/' rel='post_tag'>low risk options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nifty-options-trading\/' rel='post_tag'>Nifty options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-selling-strategy\/' rel='post_tag'>Options selling strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-basics\/' rel='post_tag'>Options trading basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-classes-in-nagpur\/' rel='post_tag'>options trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-for-beginners\/' rel='post_tag'>Options trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-india\/' rel='post_tag'>Options trading India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-strategy\/' rel='post_tag'>Options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/put-option-strategy\/' rel='post_tag'>Put option strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-near-me\/' rel='post_tag'>share market course near me<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-education-india\/' rel='post_tag'>stock market education India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/what-is-bull-put-spread\/' rel='post_tag'>What is Bull Put Spread<\/a>"},"readTime":{"min":6,"sec":20},"status":"publish","excerpt":""},{"id":663,"link":"https:\/\/stockmarketvidya.com\/blogs\/top-10-popular-world-indices-every-trader-and-investor-must-know\/","name":"top-10-popular-world-indices-every-trader-and-investor-must-know","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/Top-10-Popular-World-Indices-Every-Trader-and-Investor-Must-Know.jpg","alt":"Top 10 Popular World Indices Every Trader and Investor Must Know Nagpur"},"title":"Top 10 Popular World Indices Every Trader and Investor Must Know","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 18, 2026","dateGMT":"2026-01-18 11:19:58","modifiedDate":"2026-01-18 11:44:32","modifiedDateGMT":"2026-01-18 11:44:32","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/dax-index\/' rel='post_tag'>DAX index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/dow-jones-index\/' rel='post_tag'>Dow Jones index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/ftse-100-index\/' rel='post_tag'>FTSE 100 index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/global-indices-impact-on-indian-market\/' rel='post_tag'>global indices impact on Indian market<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/global-market-indices\/' rel='post_tag'>global market indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/global-stock-indices\/' rel='post_tag'>global stock indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/global-stock-market-for-beginners\/' rel='post_tag'>global stock market for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/hang-seng-index\/' rel='post_tag'>Hang Seng index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/international-stock-indices\/' rel='post_tag'>international stock indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/major-world-indices\/' rel='post_tag'>major world indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/msci-world-index\/' rel='post_tag'>MSCI World Index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nasdaq-index\/' rel='post_tag'>Nasdaq index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nifty-vs-global-indices\/' rel='post_tag'>Nifty vs global indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nikkei-225-index\/' rel='post_tag'>Nikkei 225 index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/popular-world-indices\/' rel='post_tag'>popular world indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/prashant-sarode\/' rel='post_tag'>Prashant Sarode<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/sp-500-index\/' rel='post_tag'>S&P 500 index<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/sensex-global-comparison\/' rel='post_tag'>Sensex global comparison<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-learning\/' rel='post_tag'>share market learning<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-basics\/' rel='post_tag'>stock market basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-education\/' rel='post_tag'>Stock market education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training-institute\/' rel='post_tag'>stock market training institute<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya-nagpur\/' rel='post_tag'>Stock Market Vidya Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/top-global-indices\/' rel='post_tag'>top global indices<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/world-indices-explained\/' rel='post_tag'>world indices explained<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/world-indices-for-indian-traders\/' rel='post_tag'>world indices for Indian traders<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/world-stock-market-indices\/' rel='post_tag'>world stock market indices<\/a>"},"readTime":{"min":6,"sec":2},"status":"publish","excerpt":""},{"id":659,"link":"https:\/\/stockmarketvidya.com\/blogs\/is-bull-call-spread-profitable-risk-controlled-options-strategy-explained\/","name":"is-bull-call-spread-profitable-risk-controlled-options-strategy-explained","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/Is-Bull-Call-Spread-Profitable.jpg","alt":"Is Bull Call Spread Profitable"},"title":"Is Bull Call Spread Profitable? Risk-Controlled Options Strategy Explained","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 15, 2026","dateGMT":"2026-01-15 16:44:15","modifiedDate":"2026-01-15 16:53:24","modifiedDateGMT":"2026-01-15 16:53:24","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/beginner-options-trading-strategy\/' rel='post_tag'>beginner options trading strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-calculation\/' rel='post_tag'>Bull Call Spread calculation<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-example\/' rel='post_tag'>Bull Call Spread example<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-explained\/' rel='post_tag'>Bull Call Spread explained<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-for-beginners\/' rel='post_tag'>Bull Call Spread for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-in-options-trading\/' rel='post_tag'>Bull Call Spread in options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-option-chain-example\/' rel='post_tag'>Bull Call Spread option chain example<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-options-strategy\/' rel='post_tag'>Bull Call Spread options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-payoff-explanation\/' rel='post_tag'>Bull Call Spread payoff explanation<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-profit-and-loss\/' rel='post_tag'>Bull Call Spread profit and loss<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-strategy\/' rel='post_tag'>Bull Call Spread strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-strategy-for-bank-nifty\/' rel='post_tag'>Bull Call Spread strategy for Bank Nifty<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-strategy-for-nifty\/' rel='post_tag'>Bull Call Spread strategy for Nifty<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-strategy-in-india\/' rel='post_tag'>Bull Call Spread strategy in India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bull-call-spread-vs-long-call\/' rel='post_tag'>Bull Call Spread vs Long Call<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bullish-options-strategy\/' rel='post_tag'>bullish options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/call-option-strategies\/' rel='post_tag'>call option strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/how-bull-call-spread-works\/' rel='post_tag'>How Bull Call Spread works<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/is-bull-call-spread-profitable\/' rel='post_tag'>Is Bull Call Spread profitable<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/low-risk-options-strategy\/' rel='post_tag'>low risk options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nism-certified-stock-market-trainer\/' rel='post_tag'>NISM certified stock market trainer<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/option-spread-strategies\/' rel='post_tag'>option spread strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-classes-in-nagpur\/' rel='post_tag'>options trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/options-trading-course\/' rel='post_tag'>options trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/risk-defined-options-strategy\/' rel='post_tag'>risk defined options strategy<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-near-me\/' rel='post_tag'>share market course near me<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/what-is-bull-call-spread\/' rel='post_tag'>What is Bull Call Spread<\/a>"},"readTime":{"min":6,"sec":18},"status":"publish","excerpt":""},{"id":646,"link":"https:\/\/stockmarketvidya.com\/blogs\/how-to-start-commodity-trading-in-india-with-small-capital-a-practical-learning-guide-for-smart-beginners\/","name":"how-to-start-commodity-trading-in-india-with-small-capital-a-practical-learning-guide-for-smart-beginners","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/How-to-Start-Commodity-Trading-in-India-with-Small-Capital.jpg","alt":"How to Start Commodity Trading in India with Small Capital: A Practical Learning Guide for Smart Beginners in Nagpur"},"title":"How to Start Commodity Trading in India with Small Capital: A Practical Learning Guide for Smart Beginners","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 10, 2026","dateGMT":"2026-01-10 14:54:33","modifiedDate":"2026-01-10 15:02:49","modifiedDateGMT":"2026-01-10 15:02:49","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-futures-trading\/' rel='post_tag'>commodity futures trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-market-india\/' rel='post_tag'>commodity market India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-options-trading\/' rel='post_tag'>commodity options trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading\/' rel='post_tag'>commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-basics\/' rel='post_tag'>commodity trading basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-classes\/' rel='post_tag'>commodity trading classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-course\/' rel='post_tag'>commodity trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-education\/' rel='post_tag'>commodity trading education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-for-beginners\/' rel='post_tag'>commodity trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-in-india\/' rel='post_tag'>commodity trading in India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-strategies\/' rel='post_tag'>commodity trading strategies<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/commodity-trading-with-small-capital\/' rel='post_tag'>commodity trading with small capital<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/derivative-trading-india\/' rel='post_tag'>derivative trading India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/how-to-start-commodity-trading\/' rel='post_tag'>how to start commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/mcx-commodity-trading\/' rel='post_tag'>MCX commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/ncdex-commodity-trading\/' rel='post_tag'>NCDEX commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/online-commodity-trading\/' rel='post_tag'>online commodity trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-near-me\/' rel='post_tag'>share market course near me<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/trading-education-india\/' rel='post_tag'>trading education india<\/a>"},"readTime":{"min":5,"sec":48},"status":"publish","excerpt":""},{"id":638,"link":"https:\/\/stockmarketvidya.com\/blogs\/what-does-gift-nifty-indicate-before-market-opens-in-india-a-traders-pre-market-compass\/","name":"what-does-gift-nifty-indicate-before-market-opens-in-india-a-traders-pre-market-compass","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/What-Does-Gift-Nifty-Indicate-Before-Market-Opens-in-India.jpg","alt":"What Does Gift Nifty Indicate Before Market Opens in India? A Trader\u2019s Pre-Market Compass"},"title":"What Does Gift Nifty Indicate Before Market Opens in India? A Trader\u2019s Pre-Market Compass","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 8, 2026","dateGMT":"2026-01-08 11:48:11","modifiedDate":"2026-01-08 11:50:08","modifiedDateGMT":"2026-01-08 11:50:08","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":6,"sec":29},"status":"publish","excerpt":""},{"id":632,"link":"https:\/\/stockmarketvidya.com\/blogs\/what-is-currency-trading-a-simple-guide-for-indian-beginners\/","name":"what-is-currency-trading-a-simple-guide-for-indian-beginners","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/What-Is-Currency-Trading.jpg","alt":"What Is Currency Trading? Currency Trading Course in Nagpur"},"title":"What Is Currency Trading? A Simple Guide for Indian Beginners","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 6, 2026","dateGMT":"2026-01-06 16:15:28","modifiedDate":"2026-01-06 16:16:56","modifiedDateGMT":"2026-01-06 16:16:56","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/currency-trading\/\" rel=\"category tag\">Currency Trading<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/currency-trading\/\" rel=\"category tag\">Currency Trading<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":6,"sec":30},"status":"publish","excerpt":""},{"id":621,"link":"https:\/\/stockmarketvidya.com\/blogs\/how-crypto-trading-works-understanding-bitcoin-altcoins-and-market-trends\/","name":"how-crypto-trading-works-understanding-bitcoin-altcoins-and-market-trends","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2026\/01\/How-Crypto-Trading-Works.jpg","alt":"How Crypto Trading Works: Crypto Trading Course in Nagpur"},"title":"How Crypto Trading Works: Understanding Bitcoin, Altcoins, and Market Trends","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Jan 3, 2026","dateGMT":"2026-01-03 08:09:45","modifiedDate":"2026-01-03 08:30:32","modifiedDateGMT":"2026-01-03 08:30:32","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/crypto-trading\/\" rel=\"category tag\">Crypto Trading<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/crypto-trading\/\" rel=\"category tag\">Crypto Trading<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/altcoin-trading\/' rel='post_tag'>altcoin trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bitcoin-and-altcoins\/' rel='post_tag'>bitcoin and altcoins<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/bitcoin-trading\/' rel='post_tag'>bitcoin trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-market-trends\/' rel='post_tag'>crypto market trends<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-risk-management\/' rel='post_tag'>crypto risk management<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-technical-analysis\/' rel='post_tag'>crypto technical analysis<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading\/' rel='post_tag'>crypto trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-basics\/' rel='post_tag'>crypto trading basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-classes\/' rel='post_tag'>crypto trading classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-course\/' rel='post_tag'>crypto trading course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-education\/' rel='post_tag'>crypto trading education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-for-beginners\/' rel='post_tag'>crypto trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-psychology\/' rel='post_tag'>crypto trading psychology<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/crypto-trading-training\/' rel='post_tag'>crypto trading training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/cryptocurrency-trading\/' rel='post_tag'>cryptocurrency trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/financial-market-training\/' rel='post_tag'>financial market training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/how-crypto-trading-works\/' rel='post_tag'>how crypto trading works<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/learn-crypto-trading\/' rel='post_tag'>learn crypto trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-education\/' rel='post_tag'>Stock market education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/trading-education-in-india\/' rel='post_tag'>trading education in India<\/a>"},"readTime":{"min":6,"sec":31},"status":"publish","excerpt":""},{"id":616,"link":"https:\/\/stockmarketvidya.com\/blogs\/why-learning-forex-trading-is-important-before-you-start-trading\/","name":"why-learning-forex-trading-is-important-before-you-start-trading","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2025\/12\/Why-Learning-Forex-Trading-Is-Important-Before-You-Start-Trading.jpg","alt":"Learning Forex Trading"},"title":"Why Learning Forex Trading is Important Before You Start Trading","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Dec 31, 2025","dateGMT":"2025-12-31 15:04:04","modifiedDate":"2025-12-31 15:04:06","modifiedDateGMT":"2025-12-31 15:04:06","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/beginner-trading-education\/' rel='post_tag'>beginner trading education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/currency-trading-basics\/' rel='post_tag'>currency trading basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/forex-market-learning\/' rel='post_tag'>forex market learning<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/forex-risk-management\/' rel='post_tag'>forex risk management<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/forex-trading-course-in-india\/' rel='post_tag'>forex trading course in india<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/forex-trading-education\/' rel='post_tag'>forex trading education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/forex-trading-for-beginners\/' rel='post_tag'>forex trading for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/forex-trading-psychology\/' rel='post_tag'>forex trading psychology<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/forex-trading-training\/' rel='post_tag'>forex trading training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/importance-of-forex-trading\/' rel='post_tag'>importance of forex trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/learn-forex-trading\/' rel='post_tag'>learn forex trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/nism-certified-trainer\/' rel='post_tag'>NISM Certified Trainer<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/orex-trading\/' rel='post_tag'>orex trading<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/prashant-sarode\/' rel='post_tag'>Prashant Sarode<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/professional-trading-skills\/' rel='post_tag'>professional trading skills<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-near-me\/' rel='post_tag'>share market course near me<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-vidya\/' rel='post_tag'>Stock Market Vidya<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/trading-education-india\/' rel='post_tag'>trading education india<\/a>"},"readTime":{"min":6,"sec":12},"status":"publish","excerpt":""},{"id":606,"link":"https:\/\/stockmarketvidya.com\/blogs\/why-every-student-should-learn-the-share-market-before-investing-a-smart-foundation-for-financial-independence\/","name":"why-every-student-should-learn-the-share-market-before-investing-a-smart-foundation-for-financial-independence","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2025\/12\/Why-Every-Student-Should-Learn-the-Share-Market-Before-Investing.jpg","alt":"Why Every Student Should Learn the Share Market Before Investing in Nagpur"},"title":"Why Every Student Should Learn the Share Market Before Investing: A Smart Foundation for Financial Independence","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Dec 29, 2025","dateGMT":"2025-12-29 05:16:39","modifiedDate":"2025-12-29 05:16:40","modifiedDateGMT":"2025-12-29 05:16:40","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/beginner-investing-education\/' rel='post_tag'>beginner investing education<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/best-share-market-classes-in-nagpur\/' rel='post_tag'>Best share market classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/financial-education-for-students\/' rel='post_tag'>financial education for students<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/investment-education-for-youth\/' rel='post_tag'>investment education for youth<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/learn-share-market-basics\/' rel='post_tag'>learn share market basics<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-awareness\/' rel='post_tag'>share market awareness<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-classes\/' rel='post_tag'>Share Market Classes<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course\/' rel='post_tag'>Share Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-in-nagpur\/' rel='post_tag'>Share Market Course in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-course-near-me\/' rel='post_tag'>share market course near me<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-for-students\/' rel='post_tag'>share market for students<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training\/' rel='post_tag'>Share Market Training<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-market-training-in-nagpur\/' rel='post_tag'>share market training in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/share-trading-classes-in-nagpur\/' rel='post_tag'>share trading classes in Nagpur<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-course\/' rel='post_tag'>Stock Market Course<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-education-for-beginners\/' rel='post_tag'>stock market education for beginners<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-learning-india\/' rel='post_tag'>stock market learning India<\/a><a href='https:\/\/stockmarketvidya.com\/blogs\/tag\/stock-market-training\/' rel='post_tag'>Stock Market Training<\/a>"},"readTime":{"min":6,"sec":50},"status":"publish","excerpt":""},{"id":601,"link":"https:\/\/stockmarketvidya.com\/blogs\/what-is-pe-ratio-how-smart-investors-use-price-to-earnings-ratio-to-choose-winning-stocks\/","name":"what-is-pe-ratio-how-smart-investors-use-price-to-earnings-ratio-to-choose-winning-stocks","thumbnail":{"url":"https:\/\/stockmarketvidya.com\/blogs\/wp-content\/uploads\/2025\/12\/What-Is-PE-Ratio.jpg","alt":"What Is PE Ratio? How Smart Investors Use Price to Earnings Ratio to Choose Winning Stocks"},"title":"What Is PE Ratio? How Smart Investors Use Price to Earnings Ratio to Choose Winning Stocks","author":{"name":"Share Market Blog","link":"https:\/\/stockmarketvidya.com\/blogs\/author\/share-market-blog\/"},"date":"Dec 23, 2025","dateGMT":"2025-12-23 14:33:49","modifiedDate":"2025-12-23 14:34:46","modifiedDateGMT":"2025-12-23 14:34:46","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a>, <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>","space":"<a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market\/\" rel=\"category tag\">Share Market<\/a> <a href=\"https:\/\/stockmarketvidya.com\/blogs\/category\/share-market-course\/\" rel=\"category tag\">Share Market Course<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":6,"sec":26},"status":"publish","excerpt":""}]